With inflation rising there is going to be more attention on government statistics like the consumer price index CPI. However these metrics don’t fully represent inflation in respect to the devaluation of fiat currency. This article explores the effects of wealth concentration and how it might affect all of our futures.

- Introduction

- Inflation, Deflation & Wealth Concentration [Video]

- Wealth Concentration

- Economic Effect

- The Next 50 Years

- Further Reading

Introduction

In recent years the gap between the global rich and poor has been widening. 3% of global wealth is distributed across two thirds of the population while the top 1% of high net worth individuals controls 47%.

Norway has the lowest inequality where the top 1% controls 21% of the wealth, South Africa has the highest where this figures rises to 70%.

0.6% of the population are USD millionaires and there are 2500 billionaires who alone control 10 trillion USD.

Inflation, Deflation & Wealth Concentration [Video]

Wealth Concentration

A gap has emerged and grown between the richest and poorest people in society. A generation of wealthy individuals aren’t spending a significant percentage of their money on goods and services, redistributing that monetary supply back into the economy.

More than ever we are seeing wealthy individuals hoard funds with no intent of ever spending them. The gamification of wealth means the rich are investing their funds rather than making material purchases and that money sits in real estate, stocks and inevitably a spreadsheet.

In stark contrast the poor are getting relatively poorer because they are spending more relative to their total income, taking out more liabilities/credit and not saving or investing anything.

As governments increase monetary supply, asset prices increase. This benefits the rich who are invested creating a vicious circle of inequality.

This also creates a barrier for new entrants to the global economy. Millennials account for 3% of the global wealth while baby boomers at the same point in their lives accounted for 27%. Generational wealth is not being passed down, yet.

Economic Effect

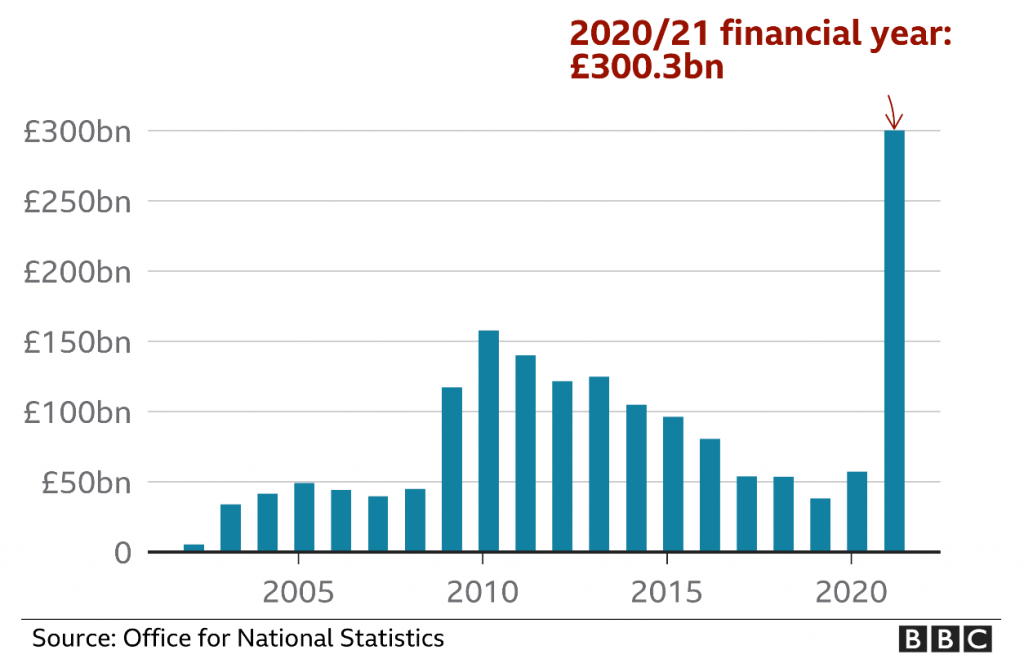

National debt is out of control in most developed global economies and is unlikely ever going to be paid back at real value. The only way to balance the books will be through inflation (lowering the value of the debt by devaluing the base currency) and quantitative easing (printing currency to pay it).

The US government began increasing monetary supply before the coronavirus pandemic but has taken this to extremes since. Trillions of new USD have been created to support the economy.

The treasury puts together packages of corporate debt and the Fed creates money to purchase them. This miracle of modern economics has meant stock markets reached all time highs during what should have been the worse recession in recent memory. Meanwhile speculation is prevalent and widespread with the mantra that “stocks only go up”.

This increase in monetary supply would usually cause inflation in most economic models yet inflation is still below central bank targets.

It is my belief that this is being caused in part due to the effect of wealth concentration on the monetary supply.

As wealth shifts to fewer individuals, who spend less as a percentage of their wealth, it takes money out of circulation. Money ends up being allocated in to asset portfolios and real estate rather than being spent in shopping malls.

This deflationary pressure is somewhat balancing the increase in quantitative easing when compared to a traditional basket of goods. However if we look at investment products it shows a different picture.

Inflation figures are below 2% in the UK, year on year growth in the stock market is around 7%, real-estate prices are increasing around the same amount. Assets are increasing in value much faster than consumer goods.

As more money gets poured in, the opportunities for investment reduce. A competitive market emerges where it becomes ever harder to find good risk adjusted investments.

Any value investors who have read Benjamin Graham’s book’s looking for stocks trading at a P/E ratio of less than 10 will have a hard time finding good companies 70 years later.

Investments have become more expensive but are all assets going up in value or is the value of our currency decreasing? Is there a significant difference?

The Next 50 Years

The baby boomer generation will inevitably die off handing their fortunes down to a new generation of trust fund kids.

From an economic perspective this could be challenging as a new generation may be more willing to relinquish these funds back into the economy, Dan Bilzerian style.

The division between rich and poor is likely to continue growing until something drastic changes the course of the monetary flow.

This could bring about social issues including increases in social unrest and political volatility. On a more positive note inequality between nations could potentially provide a valid argument towards globalization and freedom of movement.

Wealth concentration in the past has provided great advances in science, engineering and the arts. With more people today than ever not needing to work it may lead to a new renaissance period of development.

If inflation does increase then cryptocurrencies will be there to provide an alternative store of value. How high does inflation need to be before the younger generation start storing their funds in Bitcoin on apps like Revolut which already have this feature available. This could potentially further devalue fiat currencies.

If this happens could it potentially lead to a separation of state and money?

Everyone is happy when their homes increase in value, when their stocks go up. When their weekly shop starts doubling in cost while wages stagnate it’s a different matter.

Inflation in consumer goods is very different from asset appreciation from a psychological perspective but fundamentally it still equates to a devaluation of government controlled currencies aka inflation.

Conclusion

The coronavirus pandemic was the biggest shock to the global markets for a generation. Entire economies shut down while people stayed at home in lock down.

Even a black swan event like this has not stopped the widening gap between the richest and poorest members of society. This wealth concentration effect will continue until either society does something to change it (global tax agreement perhaps) or a new narrative influences the super-rich to redistribute their wealth.

It’s more important than ever for young people to break into the wealth system by avoiding debt and putting aside some savings for investments. If the rich are going to get richer for the foreseeable future then you want to be on that side of the fence.

Governments are increasing monetary supply at unprecedented rates and the majority of this will get driven into investable assets. Assets such as stocks, real-estate, crypto and commodities should all perform well against base currencies in the medium term.

Further Reading

I’m not a financial advisor or an economist, this is not financial advice. Read this instead.

https://www.lynalden.com/money-printing/

https://scholar.harvard.edu/files/straub/files/mss_richsavingglut.pdf