Huobi is the second largest crypto exchange in the world by trading volume. In this article I am going to undertake a comprehensive Huobi exchange review looking at trading, fees, HECO and the HT Token.

- Who is Huobi?

- Trading on Huobi Exchange

- Huobi Fees

- HECO | Huobi Eco Chain

- Yield Farming On HECO [Video]

- HT Token

- Conclusion

Who is Huobi?

Huobi Group was founded in 2013 by Leon Li. Huobi was originally based in Beijing and now operates globally with 1300 employees.

They have significant trading volume making them them the second largest exchange behind Binance. A time of writing 24hour volume was $44 billion with $28b in derivatives and $16b in spot.

On the spot exchange there are 909 market pairs with USDT, BTC, ETH being the main base currencies.

On the derivatives side there are large weekly and quarterly futures markets, a small options exchange, as well as coin and USDT margined swaps.

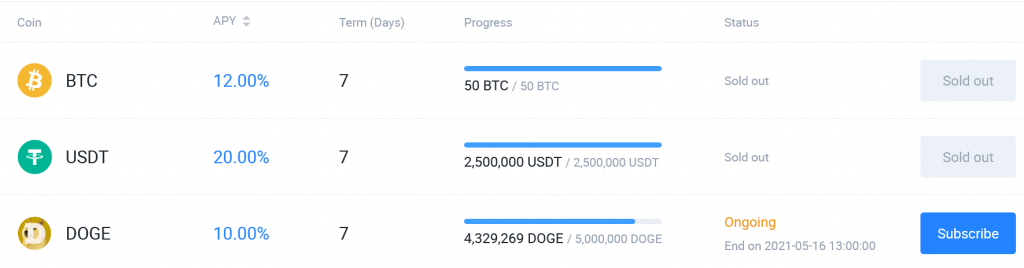

Huobi also offers an OTC desk, grid trading bot and Huobi Earn which, much like Binance Earn, enables users to generate a yield on their assets.

Trading on Huobi Exchange

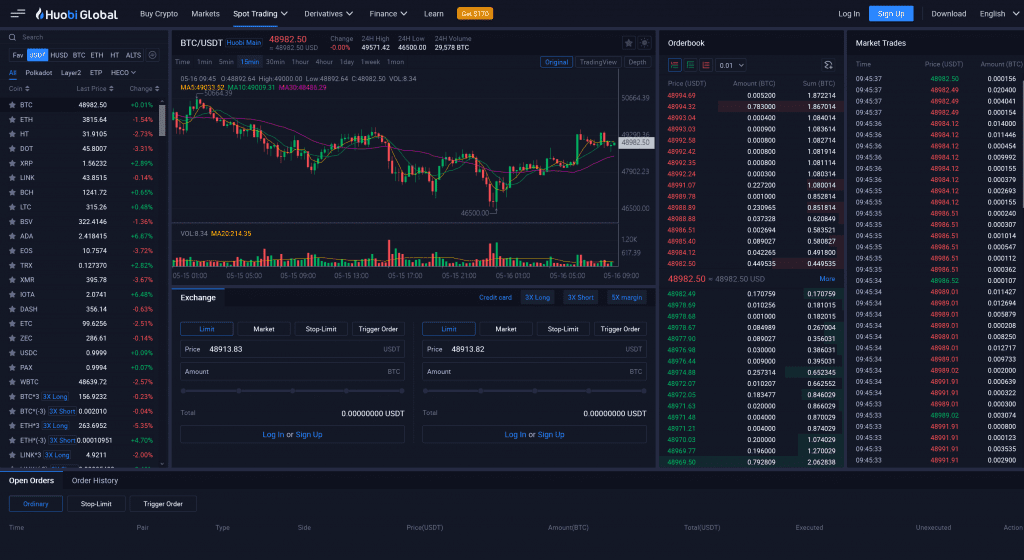

The Huobi trading set up is familiar with markets on the left, a trading view chart in the middle, order box below that, then on the right side we have the orderbook and a list of market trades.

If you’ve used other exchanges then this is very much like Binance or FTX. If you are new to exchange trading then note the orderbook which lists bids in green and asks in red. The price in the middle is the current market price. A user can place a limit order outside of the current market price to add an order to the orderbook or they can place a market order at the current market price which will remove liquidity from the orderbook at instantly settle at the best available price.

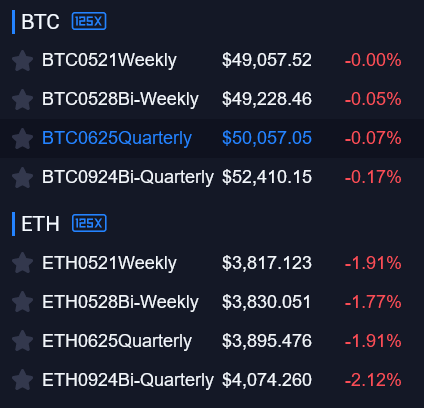

The Huobi futures markets are what originally attracted me to the platform. There can be quite a wide discrepancy between quarterly futures on Huobi and other exchanges.

Futures are separated in to weekly, bi-weekly, quarterly and bi-quarterly. The quarterly futures market is the most active and makes up the majority of the volumes traded.

Futures are available for the following markets: BTC, ETH, LINK, DOT, EOS, TRX, ADA, LTC, BCH, XRP, BSV, ETC, FIL

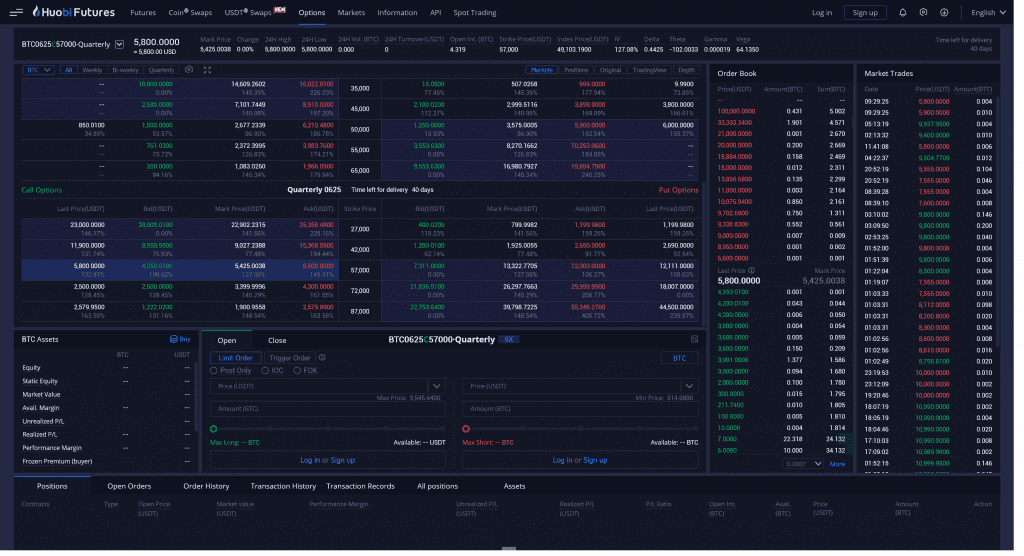

Huobi also provide an options market place however trading volume is light and order books thin which can cause wide fluctuations in pricing and resale liquidity. For these reasons I’d recommend checking pricing against Deribit before buying or selling options on Huobi.

There’s a web based wallet for storing, depositing and withdrawing assets.

Huobi Fees

Withdrawal Fees: Currently due to high gas fees ERC20 withdrawals cost around $20. You can move USDT between exchanges using TRC20 tokens for a $1 withdrawal fee. You can also withdraw USDT to the HECO chain at an even lower cost, although this may not be compatible with other exchanges.

Transaction Fees: Huobi’s standard fees are 0.2% for both maker and taker transactions. To get on to the more competitive professional trading tiers a user will need a minimum of 1000 BTC thirty day trading volumes and to stake 2000 HT tokens currently valued at $64,000 USD.

Margin Interest Rate: Margin is available at a rate of 0.0980% per day for standard users, reducing down to 0.02x% for professional tiers.

Fees reductions are also available for paying in Huobi’s native HT token.

HECO | Huobi Eco Chain

HECO is the Huobi Eco Chain, an environmentally friendly EVM compatible blockchain. It is in essence Huobi’s answer to the Binance Smart Chain and was launched in December 2020. HECO can handle 500+ transactions per second with an average block time of 3 seconds.

Tech wise it’s a clone of Ethereum with a few changes. The consensus mechanism is HPoS and there are 21 authorised validators who run the network. The readme claims to be decentralized although arguably it is CeDeFi and completely centralised, with Huobi Group having full control.

The project is open source and the code is available here: https://github.com/HuobiGroup/huobi-eco-chain

The code is being worked on by a sizeable team who are currently building developer tools, layer two solutions and a major upgrade (spark) due in Q3 2021.

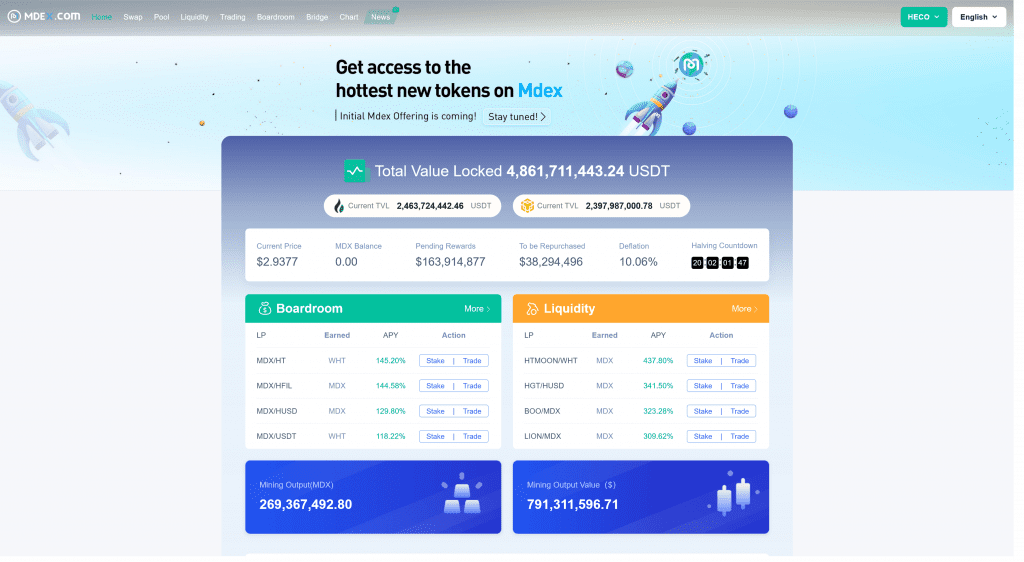

The HECO ecosystem is built around MDEX which is the largest automated market maker on the network.

MDEX is actually a cross chain platform with markets on HECO, Ethereum and Binance Smart Chain. It represents a bit of a missed opportunity for me as I looked at it very early on and declined to get involved in the MDX liquidity pools.

The platform has now grown to have nearly $2.5 billion USD in TVL on both HECO and BSC.

Update: Another interesting development is the launch of IMO’s which will launch new projects on the MDEX platform and could prove popular.

There is a list of HECO yield farms available here: https://hecoinfo.com/yieldfarms Note these may or may not be legitimate projects and careful due diligence is necessary before committing funds.

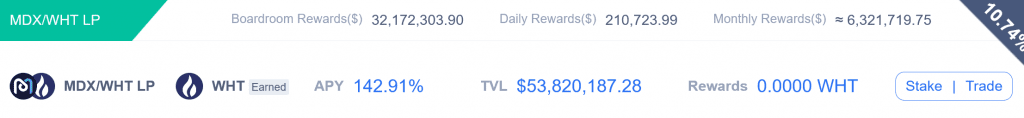

There are various liquidity pools and incentives to attract investment on the MDEX platform. One of the ones I find quite compelling is the MDX/WHT LP Boardroom Pool which provides exposure to both the MDX & HT tokens as well as providing high yields.

Yield Farming On HECO [Video]

HT Token

The HT token serves a number of purposes

- Reduced trading fees on the exchange

- Native token for the HECO blockchain (gas fees)

- Rebuy and burn tokenomics (255m burnt to date)

- FastTrack a voting system for exchange listings

Huobi’s token was launched in 2018 and has a fixed supply of 500 million. The initial distribution was:

- 300m distributed in exchange for point discount cards

- 100m user rewards and incentives

- 100m team allocation vested over four years

The points discount cards were sold as 1:1 for USDT fee values however discounts of up to 50% were offered for large amounts i.e. a user could purchase 100,000 points was sold for 50,000 USDT reducing trading fees in half.

Interestingly 20% of Huobi’s revenues are used to buy back tokens. 15% of this is via exchange and 5% is allocated to buying back the team’s tokens. This in theory should ease the selling pressure from insiders.

Conclusion

Huobi is famous for following Binance’s lead but in doing the research for this article I found a few unique innovations on their platforms such as the grid trading bot which I hadn’t seen anywhere else.

They have a lot of volume and a user demographic which is tilted towards Asia and Eastern Europe users . The majority of Bitcoin mining takes place in China and it seems like Huobi is one of the leading exchanges catering to miners needs.

This opens up variations in futures and options pricing which can lead to more efficient trading and arbitrage opportunities.

The HECO blockchain is benefiting from the high transaction fees on Ethereum and yield farming shifting to CeDeFi platforms like Binance Smart Chain and HECO. While it remains to be see seen if these blockchains have long-term appeal once the various stages of Eth2.0 are released (likely later this year) there is currently a lot of opportunity in these ecosystems.

HT is Huobi’s native token which provides exposure to the success of Huobi as an exchange and a group operating in the DeFi space. The tokenomics and burn rate are appealing and have seen a lot of growth this bull run. I believe it’s unlikely that Huobi will ever challenge Binance for the top spot on exchange trading volumes playing second fiddle to market leader is still a great position to be in.

I hope this Huobi exchange review has proved valuable and it’s helped inform your decision about what Huobi Group offers. Here is a referral link if you wish to setup a new account: https://www.huobi.com/en-us/topic/invited/?invite_code=9g9ac