Ever wondered why crypto traders are obsessed with FOMC meetings and what the Federal Reserve are planning next?

Interest rates set by the Fed impact the price of Bitcoin and other digital assets alongside stocks, shares and bonds. What if you could anticipate long-term price movements just by understanding a few macro economic principles? Let me share some insights into how interest rates affect the risk assets and why you should care.

Understanding FOMC Meetings

A simple interest rate change by the Federal Open Market Committee (FOMC) can ripple through the financial markets. If you are a crypto enthusiast or investor, understanding this connection can help plan long term investment decisions.

The FOMC is a branch of the Federal Reserve responsible for setting the direction of monetary policy in the United States. The rest of the world follows the US lead, so in effect this dictates global economics. They meet eight times a year to review economic conditions and decide on the federal funds rate, the interest rate at which banks lend to each other overnight. These decisions are crucial because they influence borrowing costs and market liquidity.

Impact on Asset Price

Interest rates have a profound influence on various asset classes, including cryptocurrencies. Lower interest rates mean cheaper borrowing costs, leading investors to seek higher returns from riskier assets like Bitcoin. More money flowing into the crypto market can drive up prices. Conversely, higher rates increase borrowing costs, making riskier investments less attractive.

At an extreme example, if you can get 10% yield on US treasury bonds per year backed by the US government with very limited downside, the average returns of the SP500 at 7% seems less attractive for a relatively higher risk investment.

Pre-covid interest rates were near zero or even negative in some parts of the world. This meant that it was cheap to borrow money, there was more money in the markets and the booming naughties saw up only price in most asset classes.

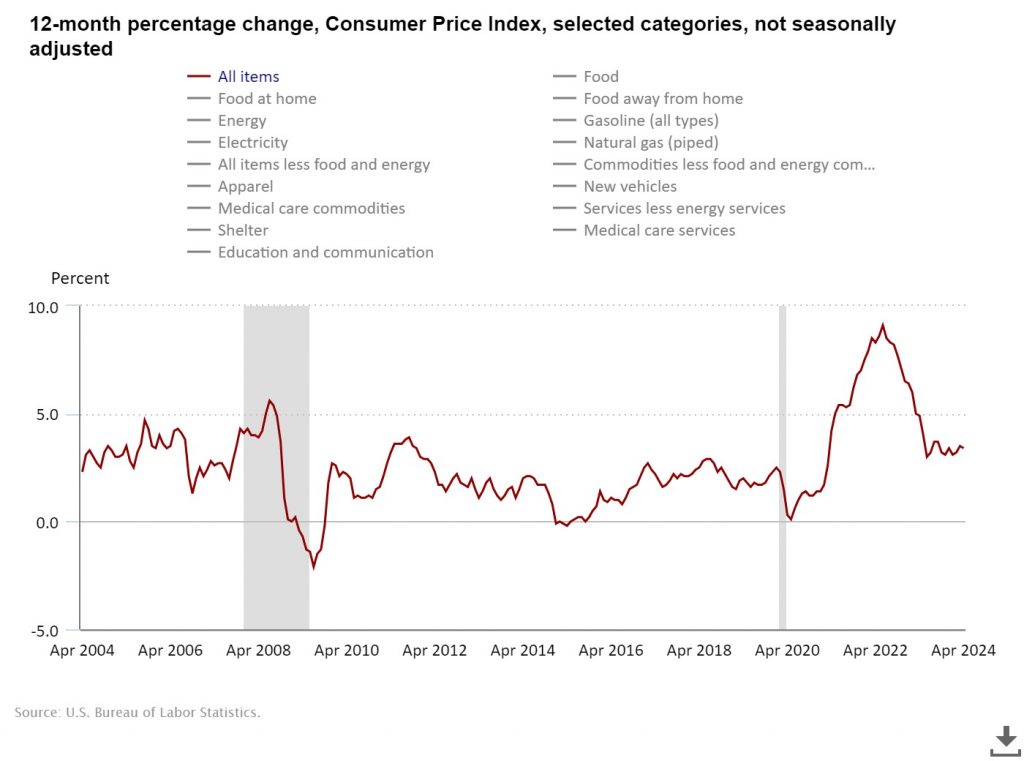

The expansion of the monetary supply during covid then led to further price increases across energy, commodities and a swift recovery in stock prices but if everything is going up in price this also means that the purchasing power of our money is going down. This is known as inflation which is generally viewed as your grocery shopping basket becoming more expensive, what it should be seen as is your savings getting secretly taxed as the government prints more money.

Inflation is a serious issue and it risked getting out of hand so the FED needed to curb it through quantitive tightening and the raising of interest rates.

Interest Rates vs Inflation

Raising interest rates helps reduce inflation by making borrowing more expensive and saving more attractive. This discourages consumers and businesses from spending and borrowing, leading to lower overall demand for goods and services. As demand decreases, businesses are less likely to raise prices, which helps stabilise and reduce inflation.

At time of writing we have seen interest rates come back down to more normal levels. Most economists will suggest a 2%~ target is where they should be and we are now at 3.4%

This has created an expectation of a reversal and the easing of monetary policy which would be beneficial to risk assets.

FOMC For Crypto

Lower rates signal an expansionary monetary policy, increasing market liquidity and driving investors towards riskier assets.

Day traders will analyse every word of the announcement looking for clues on hawkish (bearish) and doveish (bullish) signals. The FED has been known to use forward guidance to communicate its future monetary policy intentions to the public. By suggesting that it plans to lower interest rates or take other measures, the Fed can influence expectations and behaviors.

There’s always a short term impact on prices and it’s a day to expect some market volatility. The longer term influence is more significant and it can take months and years for the effects of monetary policy to fully play out.

Obviously the FED doesn’t have the final say and it’s just one factor impacting the price of Bitcoin. The four year cycle has been more significant up until now and there are many other factors impacting the markets. However for the last few years, as we’ve seen more tradfi firms become dominant in the market, Bitcoin has traded very similarly to a tech stock which is heavily influenced by FED policy. Understanding the relationship between interest rates and risk assets provides a single data point which can help make more informed investment decisions. It is not just about following trends but understanding the economic forces at play.

Next Steps

You can find information on the next FOMC meeting here:

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

This year’s FOMC meetings are set for June 11-12 2024, July 30-31 2024, September 17-18 2024, November 6-7 2024, and December 17-18 2024.

Try monitoring crypto markets during FOMC announcements, while watching the commentary on Bloomberg or some other financial media outlet. This can give you a good feel for what is happening in the economy, where we are in the market cycle and what to expect going forwards.

If you would like to stay up to date with blockchain development and emerging DeFi technology, I have a newsletter at bachini.substack.com. Join me as we navigate the exciting world of cryptocurrency together!