Calculating the intrinsic value of Bitcoin, Ethereum and other digital assets is challenging due to its intangible nature. In this analysis I’m going to discuss common methods of calculating intrinsic value and then create a model using a combination of the methods.

tl;dr based on the models described below:

- Bitcoin has a intrinsic value of $58,646.50

- Ethereum has a intrinsic value of $3,707.03

Methods Of Calculating Intrinsic Value

Store of Value

Comparing Bitcoin to gold or another asset as a store of value, can give a rough estimate of its intrinsic value. Lets calculate the market capitalization of gold and estimate what portion of that value Bitcoin might ultimately capture.

At time of writing gold has a market cap of $12.8T and Bitcoin has a market cap of $0.57T

In 10 years time our model might predict that Bitcoin adoption grows to reach half the market cap of gold which would value each BTC at roughly $650,000

Supply & Demand Model

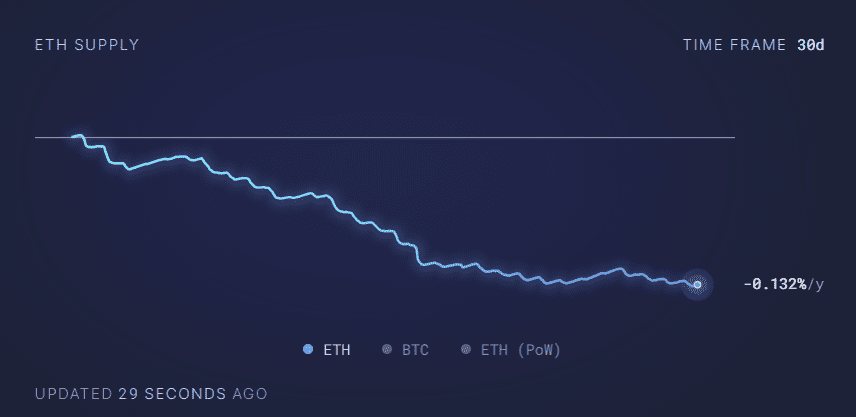

Given the limited supply of Bitcoins (21 million) and Ethereum (Loosely 120m), we can model the supply side quite accurately. New Bitcoins are minted to miners who secure the network at a current rate of 900 per day. This will drop to 450 per day following the 2024 halving event.

Ethereum supply is actually decreasing due to transaction fees being burnt which is outpacing staking rewards.

The demand side is far more difficult to model and depends largely on market sentiment, cyclical trends and institutional adoption.

For both Bitcoin & Ethereum the supply of new coins is becoming less significant compared to the distribution of early adopters holdings.

We can track long term holders and whales wallets to get an idea of the supply flows. Stablecoin issuance can also be used to estimate the amount of funds coming in to the ecosystem.

Cost of Production

We can roughly calculate the cost to mine a Bitcoin (based on electrical costs, not including upfront investment in hardware and facilities) and use this as an indicator of its intrinsic value.

Bitcoin Mining Cost Estimate

Assumptions 2023:

Network hash rate: 375m th/s*

Electrical cost: 0.0713 USD/Day for 1 THash/s*

900 Bitcoin mined per day

Cost to mine 2023 = 375m * 0.0713 / 900 = $29,708

Assumptions 2025:

Network hash rate: 500m th/s

Electrical cost: 0.0713 USD/Day for 1 THash/s

450 Bitcoin mined per day

Cost to mine 2025 = 500m * 0.0713 / 450 = $79,222

Since Ethereum migrated to a proof of stake network in 2022 there are no mining costs which makes this model unsuitable for ETH.

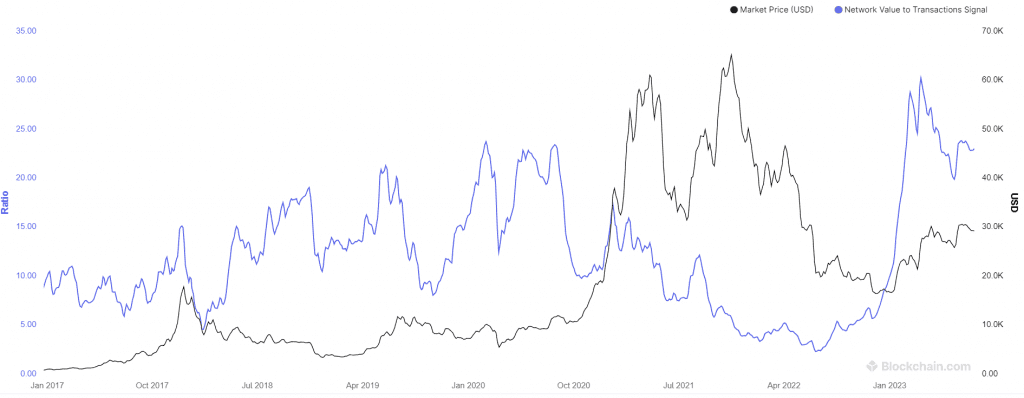

Network Value To Transactions Ratio

This approach is similar to the P/E ratio used in equity valuation. The idea is to compare the market value of Bitcoin to the dollar volume of transactions occurring on its network. A lower NVT ratio might suggest that Bitcoin is undervalued given the level of transaction activity.

We can see that NVT ratio is high currently suggesting that the asset is underpriced relative to network utility.

Relative Value

Bitcoin’s current market cap is $571B and Ethereum’s is $222B. If we have an accurate model for Bitcoin such as the cost of production model we can extrapolate a model for Ethereum and other digital assets.

Note that Ethereum is fundamentally a different asset to Bitcoin and holds a higher beta which means price will likely go up more in a bull market and go down lower in a bear market.

If we believe in the flippening which is the expectation that Ethereum market cap will at some point overtake Bitcoin’s then we can put this into our model as well.

Historical Price Analysis

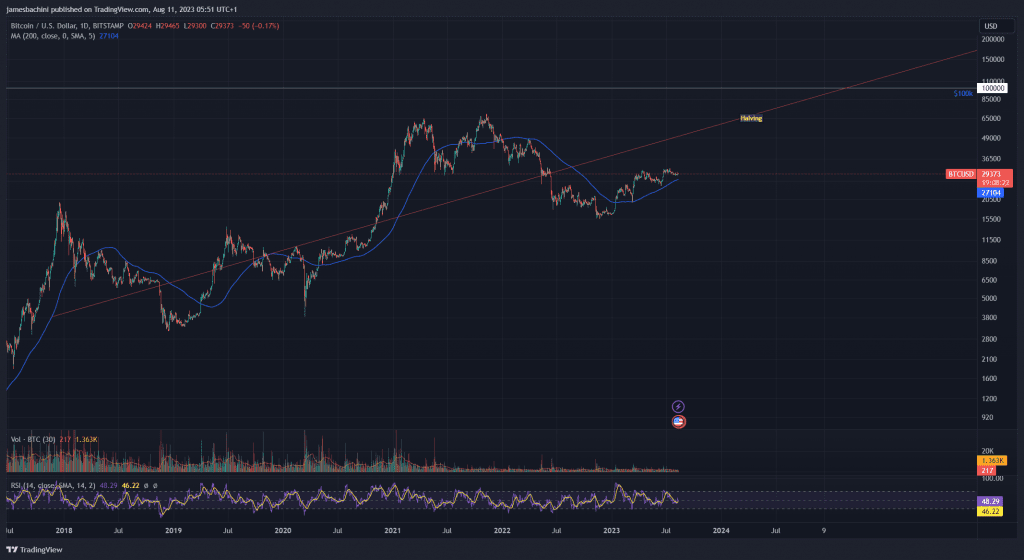

We can use historical pricing to calculate an intrinsic value based on market participants perceived value perception. To do this we can plot high time frame moving averages on a logarithmic chart and use this to draw a fair value line.

Price will always oscillate above and below the fair value of an asset depending on the stage of the market cycle. Note that changing the time frame, moving average and interpretation can create very different valuations.

The model above predicts that Bitcoin’s fair value will exceed $100,000 from Q1 2025.

Creating A Custom Model

Calculating The Intrinsic Value Of Bitcoin

We can download the hash rate and price json data from https://www.blockchain.com/explorer/charts/hash-rate

We can then use the following script to calculate the average hash-rate > price ratio for the last 8 years (two cycles) since August 11 2015.

const data = require('./hash-rate.json');

const ratios = [];

let lastHash;

// Get timestamp 4 years ago

const date = new Date();

date.setFullYear(new Date().getFullYear() - 4);

const ts = date.getTime();

data["hash-rate"].forEach(hash => {

if (hash.x < ts) return false;

data["market-price"].forEach(price => {

if (hash.x == price.x) { // check timestamps

ratios.push(price.y / hash.y);

lastHash = hash.y;

}

});

});

const averageRatio = ratios.reduce((a, b) => a + b, 0) / ratios.length;

const fairValue = lastHash * averageRatio;

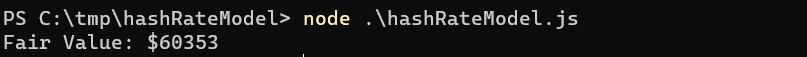

console.log(`Fair Value: $${fairValue.toFixed()}`);This model suggest that fair value is currently $60,353

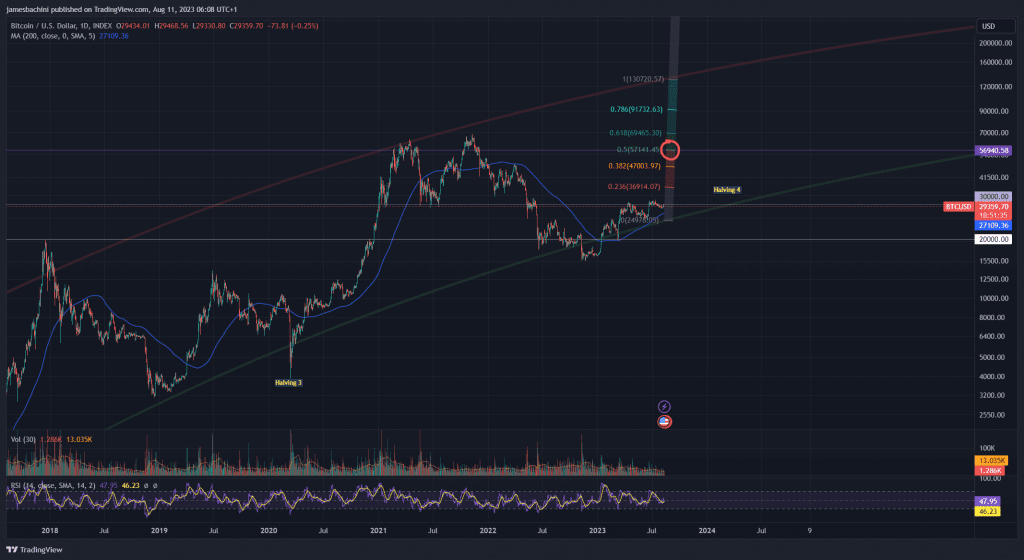

We can then plot a high time frame logarithmic curve and plotting the center point between support and resistance.

The fair value mid point of the range is currently at $56,940

If we take the average of these two methods we get an average of $58,646.50

This model combines the cost of production model with a historical price analysis.

Calculating The Intrinsic Value Of Ethereum

We can use a relative model to calculate the intrinsic value of Ethereum and other altcoins based on the Bitcoin fair value model above.

const btcPrice = 29397;

const ethPrice = 1846;

const btcFairValue = 58646.50;

const ethFairValue = btcFairValue / btcPrice * ethPrice;

console.log(`ETH Fair Value: $${ethFairValue.toFixed(2)}`)This model suggests Ethereum’s fair value is $3,682.74

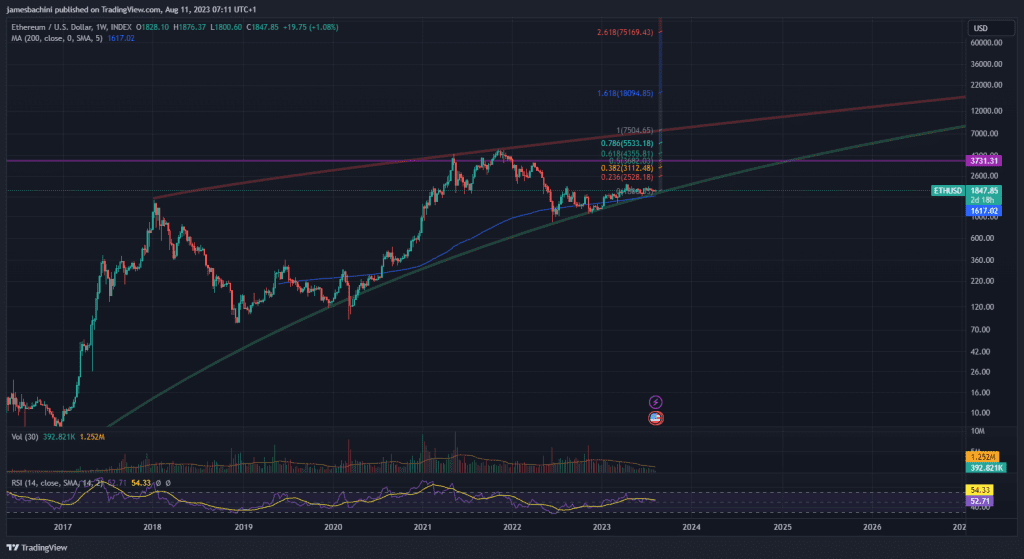

We can then plot a high time frame logarithmic curve and plotting the center point between support and resistance.

The fair value mid point of the range is currently at $3,731.31

If we take the average of these two methods we get an average of $3707.03

This model combines the relative model with a historical price analysis.

Note that I have a bias as I work in the industry as a blockchain developer and spend time in the echo chamber that is the crypto community. A critic would say that all cryptocurrencies have no intrinsic value. All these models have their limitations and are based on assumptions that may or may not hold true. I am not a financial advisor, not financial advice.