Once or twice a year the crypto markets align to provide exceptional trading volumes and volatility. I believe the Ethereum merge will presents one such opportunity for low time frame system trading.

- About The Ethereum Merge

- Denial Of Service Concerns

- Trend Following System Trading

- Ethereum Health Monitor Software

- Conclusion

About The Ethereum Merge

The merge is happening in just a few days. This is when Ethereum migrates from a proof of work algorithm to a proof of stake algorithm. And that is going to be very important for a number of reasons not least because it means that electrical usage will be reduced by more than 99%. Ethereum will become a very efficient blockchain because it no longer requires miners to use huge amounts of electricity to provide a consensus mechanism.

However, proof of stake comes with challenges and it’s not a perfect solution by any means. What you make up for in energy usage and efficiency could be argued is lost to decentralization which is fundamentally the point of what we do.

Economically, for Ethereum as an asset, the merge is extremely positive in the long term. We are cutting the supply by about 90% creating a triple halving event. This is equivalent to having 12 years of halvings on the Bitcoin network all happen at. Post merge the Ethereum miners stop getting paid completely because their services are no longer required. This cuts out a lot of the Ethereum supply going into the markets where miners had to sell their ETH to pay their electricity bills and purchase new equipment.

Whereas stakers are already hodling ETH and it seems likely that a significant percentage of the remaining distribution is simply added to their long-term holdings. We’re essentially paying out the distribution of Ethereum, to holders of Ethereum, who are less incentivised to sell it on exchange.

This combined with the EIP1559 update, which happened previously in the year means that Ethereum will become a deflationary asset. Demand for blockspace will generate fee revenue which is burnt and this will exceed the supply of new ETH to stakers.

The EIP1559 update has already been implemented and 2,600,000 ETH has been burned so far. I expect the deflationary effect of these changes to cause a short term supply shock and long-term increase in valuation relative to fiat currencies.

Centralization & Denial Of Service Concerns

There are concerns around the builder proposer mechanism which assembles the incoming transactions into blocks. Especially with things like the flashbots relay which is a centralized service running on a single domain (relay.flashbots.net). Flashbots are currently advertising that validators using the flashbots relay will earn 60% more earnings compared to staking alone. The problem is that this then puts all the incoming transactions through the flashbots relay where addresses are being censored in accordance with regulators wishes in the United States.

Flashbots open-sourced their relay code which references the FDIC list which is what was used to carry out the sanctions against Tornado Cash. We trust in validators to make sure that Ethereum is censorship resistant and globally neutral, but we’re asking validators to turn down a significant amount of short-term rewards to do that.

Another major concern I have is the potential for a denial of service attack. When the merge takes place there will be a lot of trading volume, speculation and volatility. If the merge is successful, you’d expect the price to go up, if there are short term technical issues I’d expect a short term crash.

This incentivizes a malicious actor to set up a big short position betting on the price of Ethereum to go down, then carry out a distributed denial of service attack. Potential centralisation around single points of failure could make it more feasible to carry out this type of attack. Network nodes, relays and services could be a target for an attacker to bombard the IP address with packet data and take that service offline.

Would that be the end of the road for Ethereum or a major long-term issue? Almost certainly not. It’s something that would have a short-term impact. A malicious attacker wouldn’t be able to carry on forever and some of the smartest people in industry are working on this merge update. I have the utmost confidence in the long term future of the protocol.

Short term network issues on the day when the merge is going through concerns me the most. Hopefully everything goes smoothly and the core dev team’s tremendous effort over the last few years will be rewarded.

Trend Following System Trading

So how do we trade this on the day? I think a short term trend following strategy makes a lot of sense.

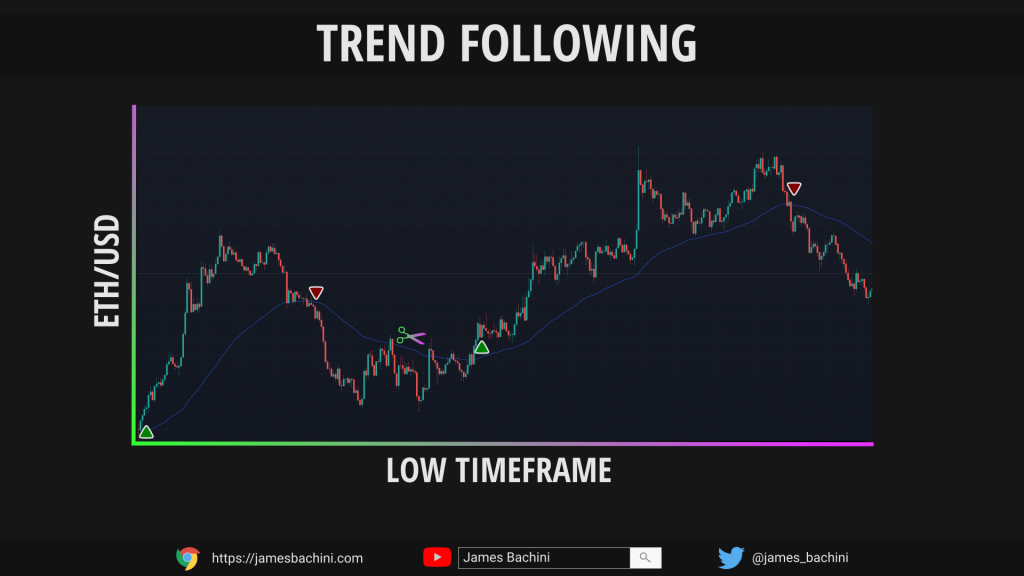

The chart above shows the benefits and difficulties when trend following. You capture the big moves but if prices start to range (see period where the scissor icon is placed) your strategy gets chopped to pieces. I believe the volume and volatility of the merge event will mean we see trending markets on ETH/USD which will be an ideal time to deploy trend following trading strategy.

I use mainly system trading bots to execute strategies and this is one of the few times where I would possibly favour market orders over limit orders because speed of execution is critical and I wont be trading with significant volume relative to the liquidity.

I’ll also have discretionary overrides in case something goes wrong. It will be important to be as early as possible to the data and have multiple sources and network health checks.

Ethereum Health Monitor Software

This is so critical that I built a custom health monitor specifically for this trading period.

The custom data logger is set up to track the state of critical infrastructure, the blocks coming through, block times, how many transactions there are per block and anything else I can think of just to ensure I can react quicker than other market participants if something goes wrong.

It is of course open source: https://github.com/jamesbachini/Ethereum-Health-Monitor

This checks a number of core infrastructure providers to check the response times. It’s currently tracking:

- Infura RPC Service

- Alchemy RPC Service

- Etherscan Web & API

- Flashbots Relay

- Transaction Count Per Block

- Mining Difficulty

- Total Difficulty (used to implement merge)

- Merge Countdown in Minutes

- Gas Prices

- Binance ETH/USDT Pair

- FTX ETH/USD Pair

- RPC Node Check (ANKR, Cloudflare, POKT)

I’ll also be running a number of execution and consensus layer client combos on cloud servers.

Conclusion

If the merge goes through successfully like we are all hoping, then I believe there is significant upside. There’s some chance that over the medium term we might see a kind of sell the news event as interest and attention fades away. However for anyone that’s hedged their position in futures markets going into the merge there will likely be a struggle for liquidity to close their short positions. There could be a liquidation cascade to either side given the amount of speculation we expect to see in the markets.

My trading plan is to use a short time frame trend following strategy with a discretionary override in case something happens.

In the long term I believe these updates will create strong tokenomics which will cause price appreciation relative to the US dollar, Bitcoin, and the majority of other cryptocurrencies.

We’ve already seen Ethereum gain some traction on Bitcoin. It’s up to levels not seen since 2018 around 0.08 BTC per ETH. If it reaches somewhere around 0.15 we will see the flippening finally take place. This is when Ethereum would take over from Bitcoin as the worlds largest cryptocurrency by market cap. Market cap is calculated by the total supply of coins out there multiplied by the price per coin. It is similar to how traditional finance prices a company in the stock markets.

Currently Ethereum doesn’t have the brand awareness. It’s not a household name like Bitcoin currently. I think if it does flip Bitcoin to become the biggest currency, retail investors and people that have invest in Bitcoin are going to be kind of finding out about this for the first time. They are going to find out why it’s important, why programmable money brings utility to the blockchain and how this project has grown to be the biggest cryptocurrency in the world. That attention could drive further speculation, which combined with the supply and demand dynamics that we’ve spoken about already could create a lot of price appreciation.