In this article I’m going to be breaking down the document filed by judge Torres yesterday and consider what it means to developers working in the blockchain and web3 space.

Highlights From The Ruling

The full document is available here:

https://www.nysd.uscourts.gov/sites/default/files/2023-07/SEC%20vs%20Ripple%207-13-23.pdf

I’ve picked out some highlights

Programmatic Sales

Having considered the economic reality of the Programmatic Sales, the Court concludes that the undisputed record does not establish the third Howey prong. Whereas the Institutional Buyers reasonably expected that Ripple would use the capital it received from its sales to

improve the XRP ecosystem and thereby increase the price of XRP. Programmatic Buyers could not reasonably expect the same. Indeed, Ripple’s Programmatic Sales were blind bid/ask transactions, and Programmatic Buyers could not have known if their payments of money went to Ripple, or any other seller of XRP

Institutional Sales

Certain Institutional Sales contracts required the Institutional Buyer to indemnify Ripple for claims arising out of the sale or distribution of XRP and other contracts expressly stated that the Institutional Buyer was purchasing XRP solely to resell or otherwise distribute . . . and not to use XRP as an end user or for any other purpose. These various provisions in the Institutional Sales contracts support the conclusion that the parties did not view the XRP sale as a sale of a commodity or a currency—they understood the sale of XRP to be an investment in Ripple’s efforts. Therefore, having considered the economic reality and totality of circumstances surrounding the Institutional Sales, the Court concludes that Ripple’s Institutional Sales of XRP constituted the unregistered offer and sale of investment contracts in violation of Section 5 of the Securities Act

The point here is that XRP sold on digital exchanges did not pass the Howey Test and did not violate securities laws. XRP sold to institutions directly did however and is considered an unregistered sale of investment contracts.

What Does This Mean For Devs?

For developers this provides rare guidance on how we should structure token generation events.

Assuming the ruling stands and any potential appeal by the SEC is unsuccessful this means tokens sold on exchange do not come under US securities laws.

Even if you aren’t based in the US, if you are building in DeFi you should be following the evolution of legislation in the worlds largest economy.

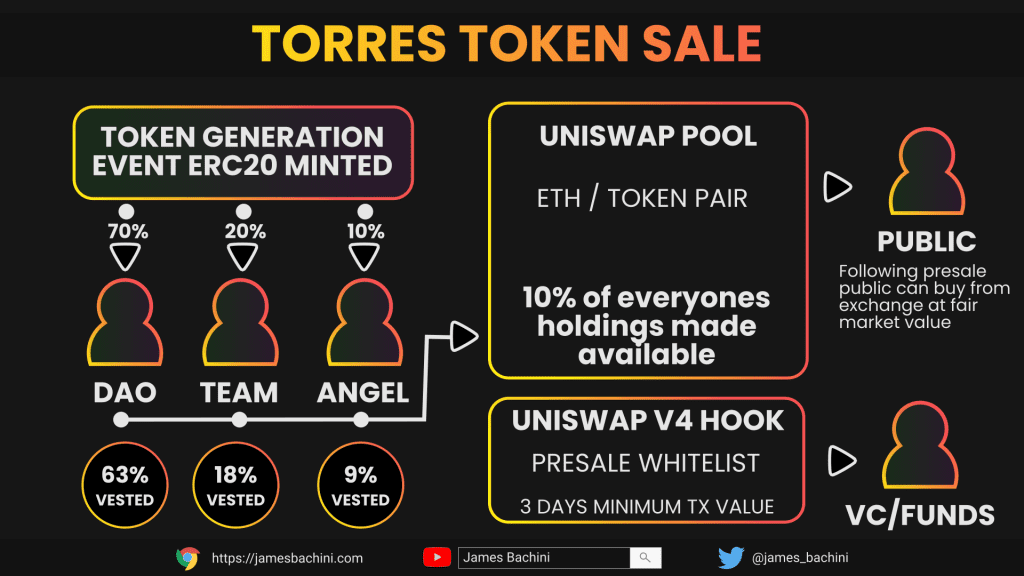

I think in the future we will see less private rounds to VC firms and crypto native funds because of this ruling. It makes sense to distribute tokens to stakeholders and make them available on exchange to the public.

There may be some kind of work around where Uniswap v4 hooks can be used to whitelist addresses for VC firms and early supporters. This presale method could last a few days to enable specific wallet addresses early access to the liquidity pool.

Lets call this the “Torres Token Sale” in honour of the judge in the case.

This would still fulfil the legal requirement that tokens are sold on digital exchanges and there is no guarantee where who’s tokens you are buying with multiple parties contributing to the pool.

VC’s still get early access to deal flow and favourable prices due to the early bird pricing. The pricing offered during the presale could be customised using concentrated liquidity positions on exchange.

Following the presale the Uniswap hook gets disabled and it becomes a standard liquidity pool that everyone can participate in.

Update I started work on some code for this. It’s currently untested and unfinished but might serve as a proof of concept:

https://github.com/jamesbachini/Uniswap-V4-Torres-Token-Sale