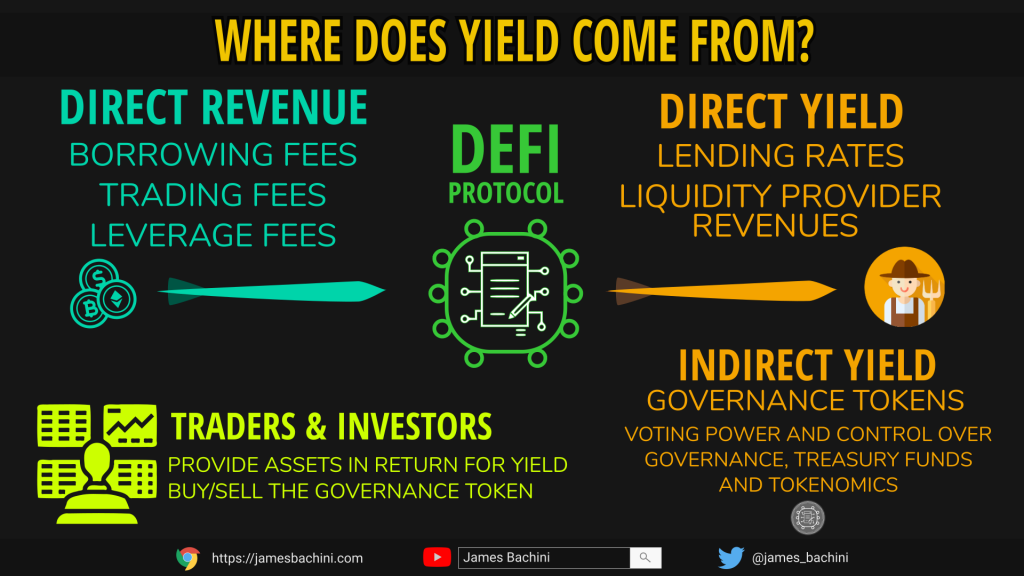

Interest rates in traditional banks are 0.1%, have you ever wondered how DeFi yield farmers are getting 20-100% yields on their digital assets? Is it sustainable wealth creation or a giant ponzi that risks collapsing in on itself. That’s the question we are going to explore in this article looking at where yield comes from in decentralised finance.

Where Does Yield Come From?

Borrowers

There is always a demand for borrowing and in DeFi this is most often seen in the form of over-collateralised loans. Because no one has a credit rating in DeFi (yet) the only way to borrow funds is to provide more collateral than you want to borrow. But why would you want to do that? Well there are a few use cases in yield farming, short trading and tax planning.

Borrowers will pay a fee to lenders and lending protocols which generates yield for the lender.

Yield Farming Stables

Yield farmers will often deposit volatile digital assets such as native tokens like ETH or SOL. They will then take a loan out in USD stable coins and use this for yield farming strategies or to gain a leveraged position. As long as the value of ETH doesn’t drop below or near the value of the USD they can use the stablecoins to do whatever and still get the gains from price appreciation on the ETH which is locked as collateral.

A borrower can normally borrow up to 80% of the value of their assets. This means they can purchase 80% more ETH then provide that as collateral to buy more ETH etc. If ETH goes up forever the value of their collateral increases allowing them to borrow more stablecoins. If the price of ETH drops sharply the borrower risks having their collateral assets liquidated and losing them.

Short Traders

A short trader will do a similar thing but they’ll provide USD as collateral and borrow ETH if they expect the price to drop. They can then sell ETH on exchange to hold USD and buy it back at a lower price later if they are right to pay off the loan.

A trader who takes out a short position makes money if the price of an asset goes down. I wrote a post about this in October just before the markets turned: How To Short Sell Crypto

Tax Planning

Because I’m always net long, in these market conditions it doesn’t matter, but in up only markets tax planning comes in to play. In many jurisdictions there is no capital gains tax on loans or money borrowed on assets. It’s still unclear whether this counts for crypto and to my knowledge we haven’t seen any legal disputes arise to date. However many users are holding their Bitcoin and Ether as collateral and borrowing stablecoins on that as a way to avoid capital gains tax.

Lenders & Lending Protocols

If borrowers are paying fees to borrow assets then lenders and lending protocols can earn a yield by providing those assets. DeFi protocols such as AAVE use this economy to generate yield for users that deposit and lend out their funds.

Trading Fees

Another source of yield is trading fees from decentralised exchanges and trading platforms. When someone trades one digital asset for another they will generally pay a fee. Uniswap for example has a standard fee of 0.3%. These fees form some of the most important revenue streams for DeFi protocols.

Liquidity Providers

Liquidity providers deposit funds to decentralised exchanges for traders to buy and sell against. Often this will be in the form of a liquidity pair such as ETH-USDT. Equal values of ETH and USDT will be provided to the liquidity pool and a trader can then swap some ETH and take out some USDT or visa versa. The trading fees are paid to liquidity providers to compensate them for lending their assets and to offset impermanent loss.

These trading fees can also be gained in yield farming vaults which accept deposits and then use strategies to optimise the amount of trading fees gained for the amount of funds deposited.

Leveraged Traders

In both traditional finance and crypto there is a strong demand for leveraged trading. Leverage allows a user to make larger bets on whether an asset will go up or down.

Let’s explain this with an example where a $MISC token is valued at $100. A trader that has $1000 in his account can buy 10 tokens and if they go up 50% he will make $500. If he used 10x leverage he could borrow the funds to buy 100 tokens and if it goes up 50% he’ll make $5000 a 5x return on his investment. There are risks here where the trader gets liquidated on a small drop in price but there is still demand for this product in financial markets.

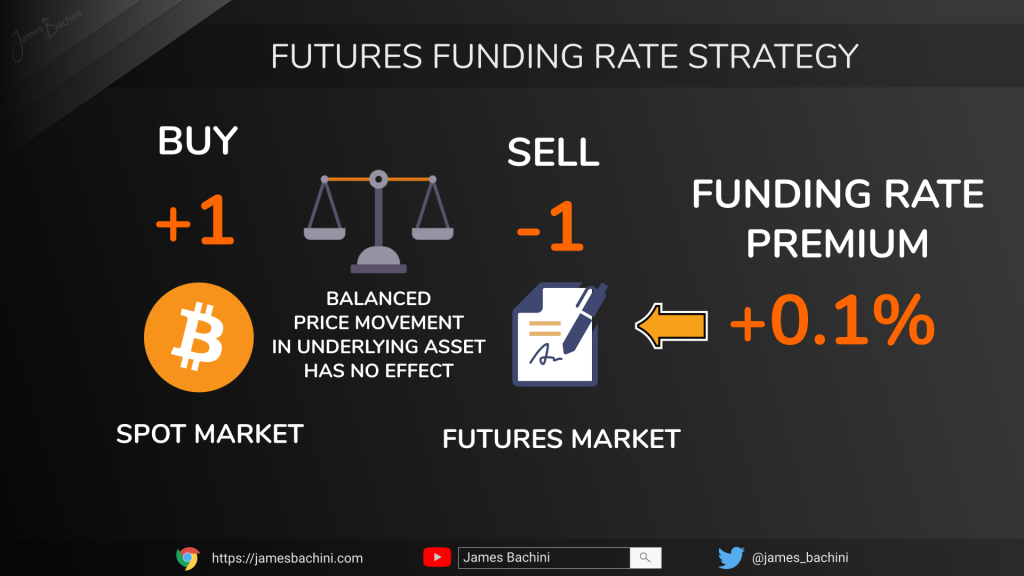

Leverage is often used on derivative products such as options and futures contracts. These contracts carry a funding rate premium which is a type of fee for the holder. If more people want to go long (betting the market will go up) than short then the longs will pay the shorts a premium.

This opens up the opportunity for a cash and carry strategy where a trader or protocol will buy 1 digital asset and then open a short position for the same amount. If the asset goes up or down they are hedged so it doesn’t matter and they collect the funding rate premium.

We are only starting to see this come in to DeFi as decentralised trading volumes increase but this will likely grow in the future and protocols such as Perpetual Protocol and Ribbon Finance are worth keeping an eye on to gauge the timing of this shift.

Governance Tokens

Governance tokens make up the majority of value creation in decentralised finance.

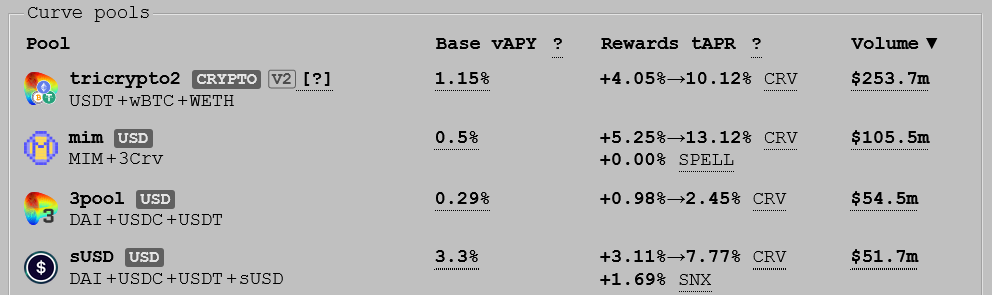

A borrowing and lending platform might offer 3% to lenders with another 20% made up from the distribution of governance tokens. I recently wrote an article about the Curve Wars which demonstrates this well with the boosted pools.

Curve gives depositors the trading fees from the platform but further incentivises liquidity with the distribution of governance tokens.

Governance tokens hold a lot of value because:-

- In the case of a DAO they control the future of the protocol through voting

- They often control vast treasury funds, Uniswap has $7B in their treasury

- They control the flow and distribution of newly minted governance tokens

Often when the supply of a governance token is too high we see a price decline over time on exchange as they are sold off by yield farmers. When DeFi protocols get it right the governance token price increases over time further incentivising adoption by yield farmers, investors and traders.

Ponzi or Value Creation

So much of the value in yield farming comes from the distribution of governance tokens that the whole system relies on us agreeing they hold value. Remember that DeFi has only been around a couple of years and we’ve never had a bear market since its inception. Inevitably we will see one and it will be a stress test for the economic models of many DeFi protocols.

Does that mean that DeFi and yield farming is a ponzi scheme? No. Clearly the protocols, decentralised exchanges and lending platforms are generating value. As long as they continue to be used they will continue to generate value for their token holders and liquidity providers.

Not all protocols are created equally however and eventually perhaps we see a rush to quality as the platforms that generate direct revenues win over the latest and greatest farm tokens.