In this article I’ll explore 3 ways in which you can raise funds for your project with web3 products.

Membership NFT

A NFT is a non-fungible token, they are often represented as a unique image which can contain additional rights such as:

- Underlying collateral, the token contract can hold other NFT’s or Tokens

- Future rights to a product or service, NFT holders get unrestricted access to the service being built as a founding contributor etc.

- Ownership rights over a product or service

- Voting rights for an organisation such as a DAO

To execute a NFT drop, the following steps can be taken:

- Building a community of interested prospective customers through marketing and engagement farming.

- Offering whitelist access in exchange for referrals and tasks. For instance, users who tweet about the project will be whitelisted, allowing them to add their Ethereum wallet addresses to the approved pre-sale users list.

- The NFT contract is deployed to a blockhcain

- A NFT drop event takes place where users can pay a fee to mint their tokens. Whitelisted addresses are given priority to purchase the tokens. The sales page would be hosted on a dedicated website, where users connect their wallets, click “mint,” and are charged x ETH.

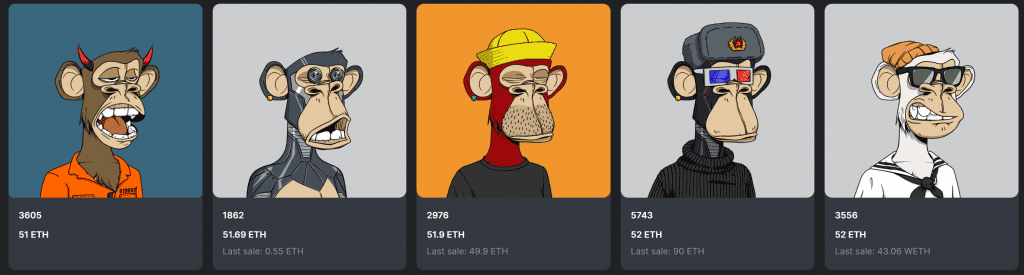

If any NFTs remain unsold after three days to the whitelisted community, they can be made available for public sale. Holders will then list NFT’s for resale on secondary markets such as OpenSea.

It’s worth noting that the NFT ecosystem has experienced a decline in interest among market participants over the past year, with 90%+ of them losing interest. This trend poses challenges for marketing efforts.

Memecoin

The PEPE memecoin very quickly became a billion dollar market cap product as investors piled in, enriching earlier investors. Memecoins work like ponzi games where buying early and selling at the top of the pump makes money.

PEPE was an outlier which exaggerates the potential of this strategy for fundraising purposes but it can still be a simple way to create a valuable product and raise capital.

The idea is to create something compelling and hope it will gain traction. It’s a bit like buying a lottery ticket, as you never know what will go viral and what will be ignored. The process of achieving this can be relatively simple and straightforward.

Here’s an outline of the steps involved:

- Mint ERC20 tokens and set the initial price.

- Place these tokens in a single-sided liquidity pool on Uniswap.

- Launch a viral marketing campaign to generate interest and drive sales.

- As people start buying the tokens, the price will increase.

- Early buyers can make a profit by selling their tokens back into the Uniswap liquidity pool.

- It’s unlikely that the pool will ever be completely sold out because supply and demand eventually reach equilibrium. Buyers end up purchasing tokens from sellers rather than from the initial supply.As the project founder, you have several options:

- You can implement a mechanism to remove a specific amount of liquidity at a predetermined time.

- You can purchase the first x amount of tokens yourself.

- Alternatively, you can mint a certain number of tokens for free and gradually sell them back over time (using a TWAP strategy). In most cases, founders or project creators are the first to buy tokens since they can’t lose money. They can always sell their tokens back for the initial purchase price, and if others buy, they can sell them at a higher price.

As the project founder, you have several options:

- You can implement a mechanism to remove a specific amount of liquidity at a predetermined time.

- You can purchase the first x amount of tokens yourself.

- Alternatively, you can mint a certain number of tokens for free and gradually sell them back over time (using a TWAP strategy).

In most cases, founders or project creators are the first to buy tokens since they can’t lose money. They can always sell their tokens back for the initial purchase price and if others buy, they can sell them at a higher price.

Whatever you do on chain is publicly visible via a block explorer so be transparent with the community about your intentions to raise capital.

How Selling A Memecoin Works

ERC20 tokens such as memecoins can be sold either via a TGE (Token generation event) which is another name for an initial coin offering or ICO as they were known in 2017, or via a decentralized exchange such as Uniswap.

The mechanics of Uniswap can be visualized as two buckets on opposite ends of a balance scale. Initially, only one of the buckets contains tokens. As people buy tokens, they add ETH or stablecoins to the other bucket and withdraw meme tokens from the filled bucket. The price fluctuates based on the relative weight of each bucket.

There is more information on creating memecoins and Uniswap liquidity pools in this tutorial

DAO Governance Token

A DAO (Decentralized Autonomous Organization) is a widely used concept in DeFi for managing ownership of decentralized protocols.

The underlying technology behind a DAO is similar to that of a memecoin, but instead of being purely memetic, the token offers voting rights and potentially a share of earnings. However, securities laws are unclear when it comes to distributing earnings. While some projects suggest it might be possible in the future with regulatory compliance, it’s a more significant concern in the US, given its highly regulated market. Therefore, caution is advised, and seeking legal advice is recommended if you wish to pursue such endeavors. Realistically, most lawyers will likely discourage buying Bitcoin and similar assets.

With governance tokens, a token allocation is typically established. For instance, it could be structured as follows:

Total Supply: 100,000,000 tokens

Token Initial Price: £1.00 GBP

| Founders | locked/vested | 10,000,000 |

| Team | locked/vested | 7,000,000 |

| Advisors | locked/vested | 3,000,000 |

| Private Sale (Crypto VCs) | locked/vested | 25,000,000 |

| Public Sale (TGE General Sale) | unlocked | 25,000,000 |

| Liquidity Provision | distributed | 10,000,000 |

| DAO Treasury | locked/vested | 20,000,000 |

The general idea is to sell 25 million tokens to VCs and 25 million through a TGE (Token Generation Event), which functions similarly to an NFT drop, allowing the general public to participate.

Locked and vested tokens cannot be sold until the vesting period is over, typically ranging from 6 months to 4 years. However, token holders can often still exercise voting rights during this period.

VC deals would involve using a SAFT (Simple Agreement for Future Tokens), a concise legal contract.

For the TGE, it is advisable to build a community first and whitelist active members before launching the event.

Following the launch, the liquidity provision tokens, along with a percentage of the raised capital, can be utilized to establish a secondary market on Uniswap.

The DAO would then vote on various matters, and users holding a significant number of tokens can create proposals. There is a third-party tool called Snapshot, which is recommended for DAO voting and managing related aspects.

Another consideration is that if the project succeeds, founders, team members, and advisors can sell a portion of their tokens for personal gains on secondary markets after the vesting period concludes.

Building Web3 Products

Building Web3 products can be an exciting venture, but it requires time, planning and budgeting. Let’s look at the process, timelines, costs, and potential avenues for funding.

Timeline

Building a Web3 product typically takes between 3 to 6 months. A memecoin can be deployed in under a minute but don’t underestimate the marketing side of it which can take months to gain traction. I would recommend starting with marketing and community building activities to validate the demand before investing significant resources in development.

There’s more information on a typical build process for founders looking to work with an external developer or team

Marketing and Community Building

If possible allocate resources for hiring a skilled Web3 marketing professional, preferably someone with a successful track record. Consider outsourcing an additional community manager or social media manager to effectively engage with your target audience.

There are many ways to market a web3 product and build a community but these are 4 of my favourite

- Run paid ads, while lots of mainstream ad networks have banned crypto ads there are crypto native ad networks where you can advertise banner ads on popular sites related to crypto

- Create content, this is more of a long term strategy but it is important for a multitude of reasons. SEO organic free traffic from Google takes a long time to build authority in a niche and start getting significant volumes. Creating content is more about engaging existing audiences and communicating your message, brand alignment and value proposition. It should be seen as a way to develop leads rather than just a top of funnel activity.

- Influencer marketing, crypto has a lot of influencers that will promote your product or do reviews for a fee. I do not offer this personally (please don’t ask) but there are price lists available for the influencers that do. Managing an influencer campaign can be very time consuming and results vary. Consider hiring a specialist who has experience in web3 influencer marketing and connections throughout the industry.

- Partnerships, the blockchain sector is rife with pointless partnerships and the reason for this is that there is opportunity for cross-promotion. When announcing partnerships you get your product in front of their audience and follower base and they get theirs in front of yours. It creates a win win and many blockchain projects will have a business development manager that is actively looking for new partnership opportunities.

Development Budget

Budgeting for product development depends on the complexity of your project. The cost may be higher for building a DAO governance token or conducting an NFT drop, while a memecoin project could be at the lower end of the range.

You are likely going to need a Solidity developer, perhaps a separate frontend developer, marketing personnel and maybe someone doing biz dev. While you can probably do all of these things on your own as a technical founder, it’s very difficult to execute everything effectively and you’ll be spending time answering reply guys on Discord when you should be making executive decisions and doing public appearances to reach larger audiences.

Remember that there will be ongoing costs for managing the DAO or project after the fundraising phase. Plan for these expenses accordingly. Additionally, consider allocating a budget for creating documentation such as whitepapers or pitch decks if needed.

VC Feedback

Consider preparing a pitch deck and seeking feedback from venture capitalists (VCs), even if you are not seeking VC investment. This can serve as a litmus test for your idea.

You can find a list of VC emails in the Web3 space or explore active Web3 investors at https://defillama.com/raises/active-investors.

The best-case scenario is receiving constructive feedback from professionals, potentially leading to the option of closing a private funding round via SAFT prior to starting development. Conversely, if you receive no replies or negative feedback, it is an indiciator that further work is needed to refine your offering.

By following these guidelines, non-technical founders can embark on the journey of building Web3 products with a clear roadmap, appropriate budgeting, and potential avenues for funding and validation.