Trading

-

Fooled by Randomness Summary – Nassim Nicholas Taleb

Nassim Nicholas Taleb’s “Fooled by Randomness” is an exploration of how humans chronically misinterpret luck as skill, patterns as laws, and anecdotes as evidence. Writing from the vantage point of a mathematical trader and probabilistic philosopher, Taleb argues that much of what we take to be causation is in fact the noisy outcome of probabilistic…

-

System Trading Bot Design Breakdown

In this post I’m going to breakdown the different parts of a system trading bot that I built to execute trend following and mean reversion strategies. There’s a short video here if you prefer a quick walkthrough: https://youtube.com/shorts/3tWl4ETbqTw Building a robust and profitable system trading bot requires careful planning, solid architecture, and a deep understanding…

-

Can ChatGPT & Keras Predict The Price Of Bitcoin

I get asked a lot if ChatGPT can be used for trading and I normally say “no, it’s a language model which isn’t designed to find market patterns in numerical price data”. ChatGPT works more like predictive text in a search engine or on your phone but what it is good at is writing code…

-

Frontrunning Crypto Catalysts For Fun & Profit

There is opportunity in crypto markets if you can get ahead of the next narrative and allocate capital prior to mass of market participants. Staying ahead of the curve often means keeping an eye on emerging trends and strategic moves that can significantly impact a project’s market perception and value. In this article I’m going…

-

Understanding RFQ in Crypto | Request For Quote Systems

Uniswap recently announced they are developing an RFQ (request for quote) system that will change the way we swap digital assets. In this article we will look at RFQ in crypto and how it works. How RFQ Works RFQ works when a buyer invites sellers to bid on specific amount of an asset. The buyer…

-

VEGA DeFi Derivatives Protocol | DeFi Analysis Report 🔍

VEGA is a dedicated appChain built for decentralized derivatives such as futures and options contracts. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to VEGA at time of writing. Do your own research, not investment advice. Vega is a infrastructure layer…

-

ApeX Pro | DeFi Analysis Report

ApeX Pro is a non-custodial decentralized orderbook exchange which is part of the ByBit group. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ApeX at time of writing. Do your own research, not investment advice. What Is ApeX Pro?…

-

Trading The Lifecycle Of Crypto Narratives

The blockchain sector moves fast and attention shifts rapidly as crypto narratives emerge inflating valuations for sub-sectors before moving on to the next big thing. In this article I’m going to outlay my research into the lifecycle of crypto narratives to explore how we can best position our portfolios and allocate funds in a +EV…

-

Technical Analysis For Crypto Degenerates

For cynics technical analysis is seen as astrology for middle aged white guys for others it is the holy grail, which when mastered, inevitably leads to trading success. The truth is somewhere in the middle, it is undeniable that price action reacts more at some levels than others. It’s important for anyone involved in investing…

-

DeFi Futures – GMX vs DyDx

Trading DeFi Futures products on decentralized exchanges such as GMX and DyDx has never been easier. The user experience is getting close to on par with centralized exchanges. Liquidity however, not so much… In this article we will look at how DeFi futures work, the market opportunity for decentralized futures exchanges and the two most…

-

Crypto Market Thesis 2023

Once viewed as a fringe market for tech-savvy libertarians, the crypto market has grown exponentially in recent years and is now being recognized as a legitimate asset class by mainstream investors. As we move into 2023, the crypto market is at a crucial juncture, with the potential to continue its explosive growth or face regulatory…

-

Mean Finance | How To DCA With DeFi

Mean Finance is a DeFi protocol that enables users to dollar cost average (DCA) into a position for an ERC-20 token. In this article we will look at why dollar cost averaging is useful and how Mean Finance works. Why Dollar Cost Average Dollar cost averaging is an investment strategy that simply breaks a entry…

-

Trading The Merge

Once or twice a year the crypto markets align to provide exceptional trading volumes and volatility. I believe the Ethereum merge will presents one such opportunity for low time frame system trading. James On YouTube Watch On YouTube: https://youtu.be/3ltpF4UGir4 |Subscribe About The Ethereum Merge The merge is happening in just a few days. This is…

-

Blood in the streets for crypto markets

A year ago I outlined my 60/40 digital asset portfolio which was 60% crypto and 40% USD stablecoins. One of the biggest benefits to this portfolio is that during market downturns it leaves you with capital to deploy. Today has been one of the most chaotic days in crypto markets ever and I’m going to…

-

Which Token Will Coinbase List Next?

Coinbase has come under criticism for insider trading which has led them to open up about what tokens they are considering listing in the future. In this article we will look at the opportunity this brings alongside an analysis of all 50 projects. We will end by looking at how we can identify and track…

-

The Rise Of DyDx And Decentralized Trading

In May 2016 Bitmex launched the XBTUSD market, a perpetual futures contract which simplified traders ability to bet on the price of Bitcoin going up or down. Today perps are traded on the major exchanges at higher volumes than the underlying spot assets. DyDx took this concept and packaged it in to a decentralized trading…

-

How To Trade Crypto | Ultimate Guide To Trading Bitcoin, Ethereum & Altcoins

This ultimate “How To Trade Crypto” guide is provided for educational purposes. I am not a financial advisor, not financial advice. The vast majority of active trading in crypto markets is done on centralized exchanges such as Binance and FTX. The high volumes on perpetual futures on both exchanges has proven the demand for leveraged…

-

The Truth About Where Yield Comes From In DeFi

Interest rates in traditional banks are 0.1%, have you ever wondered how DeFi yield farmers are getting 20-100% yields on their digital assets? Is it sustainable wealth creation or a giant ponzi that risks collapsing in on itself. That’s the question we are going to explore in this article looking at where yield comes from…

-

How To Short Sell Crypto

Short selling the best asset class of the the last 10 years is a risky venture at the best of times. However there are situations where it can be profitable to get the shorts in while markets or individual token valuations are crashing. In this article I’ll be explaining how to short sell crypto such…

-

Bitcoin ETF | Why A Bitcoin ETF Changes Everything

On Tuesday 3rd August the head of the SEC gave the clearest signal yet that they are readying for the approval of the growing list of Bitcoin ETF products awaiting regulatory approval. “I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded Bitcoin futures” Gary Gensler @…

-

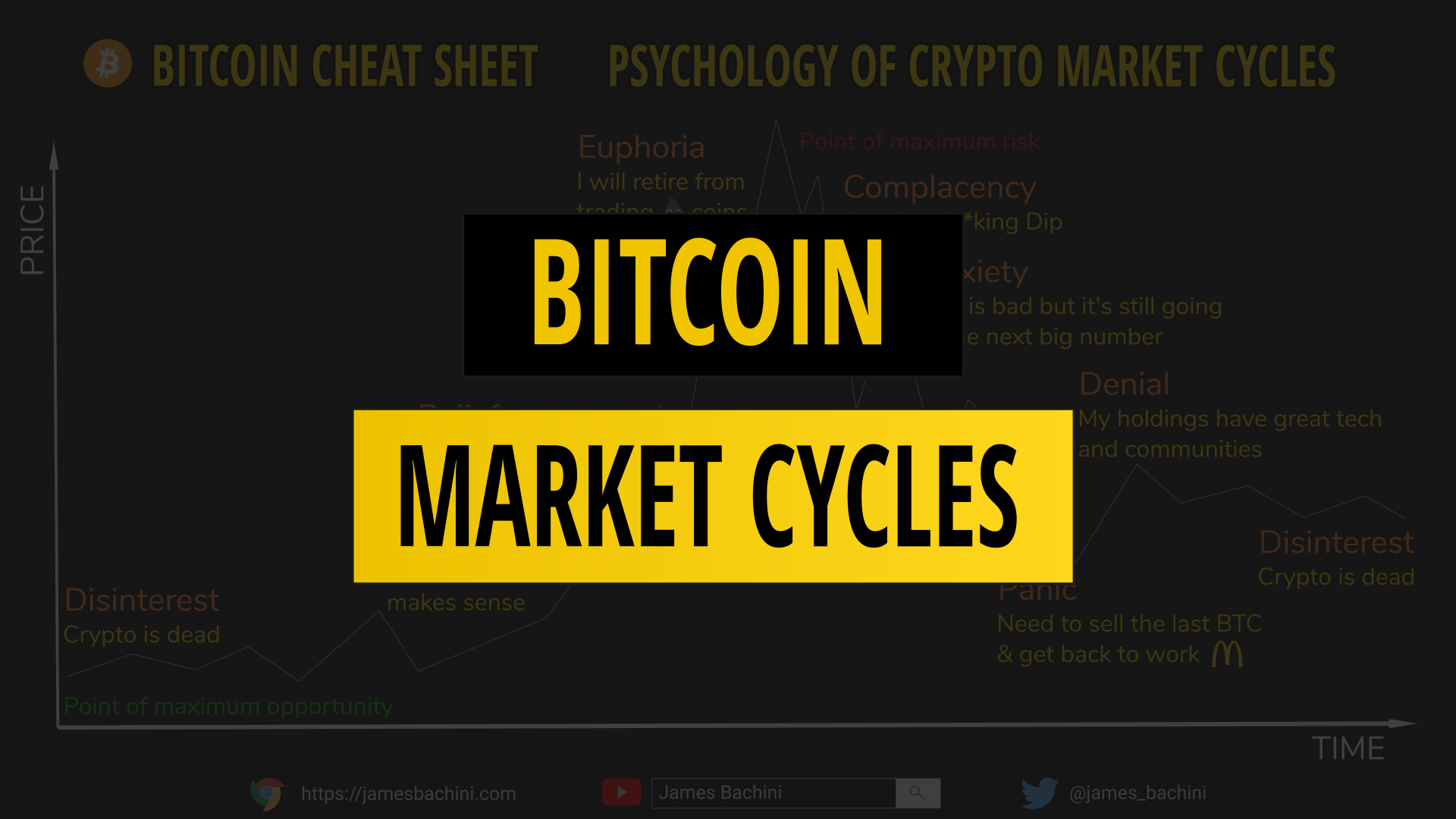

Bitcoin Market Cycle | How To Navigate Crypto Market Cycles 📈

The Bitcoin market cycle is volatile and emotionally challenging for investors but both Bitcoin and the wider crypto sector follow familiar cycle dynamics to other markets. Prophecy Was Given To Fools While I’ve never found a way to predict what the market will do next it’s both useful and fairly easy to understand where you…

-

Bit.com Review | A New Crypto Exchange

In this Bit.com review I’ll take a first look at a new exchange from the co-founder of Matrixport and Bitmain. Bit.com Review & Demo [Video] James On YouTube Who Are Bit.com? Bit.com is a new exchange registered in the Seychelles offering spot, futures and options markets for digital assets. The chairman is Jihan Wu who…

-

Order Execution Strategy Tests 📋

In this article I’m going to test different methods to find the best order execution strategy for buying and selling cryptocurrency. I’m going to define a test to enter and exit a delta neutral position, write trading bot code for each strategy in NodeJS and execute each on an isolated exchange sub-account to see which…

-

Huobi Exchange Review

Huobi is the second largest crypto exchange in the world by trading volume. In this article I am going to undertake a comprehensive Huobi exchange review looking at trading, fees, HECO and the HT Token. Who is Huobi? Huobi Group was founded in 2013 by Leon Li. Huobi was originally based in Beijing and now…

-

60/40 Crypto Portfolio | The Worlds Most Boringly Effective Cryptocurrency Portfolio

The 60/40 crypto portfolio is a modern version of the stocks and bonds retirement portfolio that has been around for over 70 years. The idea behind a 60/40 portfolio is to allocate 60% of an investment portfolio to high risk assets (stocks or cryptocurrency) and 40% to a yield producing low risk asset (bonds or…

-

Uniswap V3 Trading Bot 🦄

In this tutorial I’ll be explaining how I built Uniswap v3 trading bot in preparation for arbitrage opportunities. We will be looking at why Uniswap v3 is important and how concentrated liquidity pools provide new features such as range orders. I’ll then show how I built and tested the trading bot prior to Uniswap v3…

-

Twitter Trading Bot | Elon + DOGE = Profit

In this article I’ll share how I built a Twitter trading bot to trade a cryptocurrency called DOGE every time Elon Musk tweeted something mentioning it. I’ll be using NodeJS to query the Twitter API and then executing trades on FTX. Building A Twitter Trading Bot Video James On YouTube The “Elon Effect” Opportunity Anything…

-

Sharpe Ratio Explained | How To Calculate Risk Adjusted Returns

In this article we look at how to calculate risk adjusted returns using the sharpe ratio. We look at some modern examples which you can try using the share ratio calculator. Sharpe Ratio Calculator This calculator uses the simplified Sharpe ratio as discussed here. Possibilities Success Chances: % Return: $ Break Even Chances: % Return:…

-

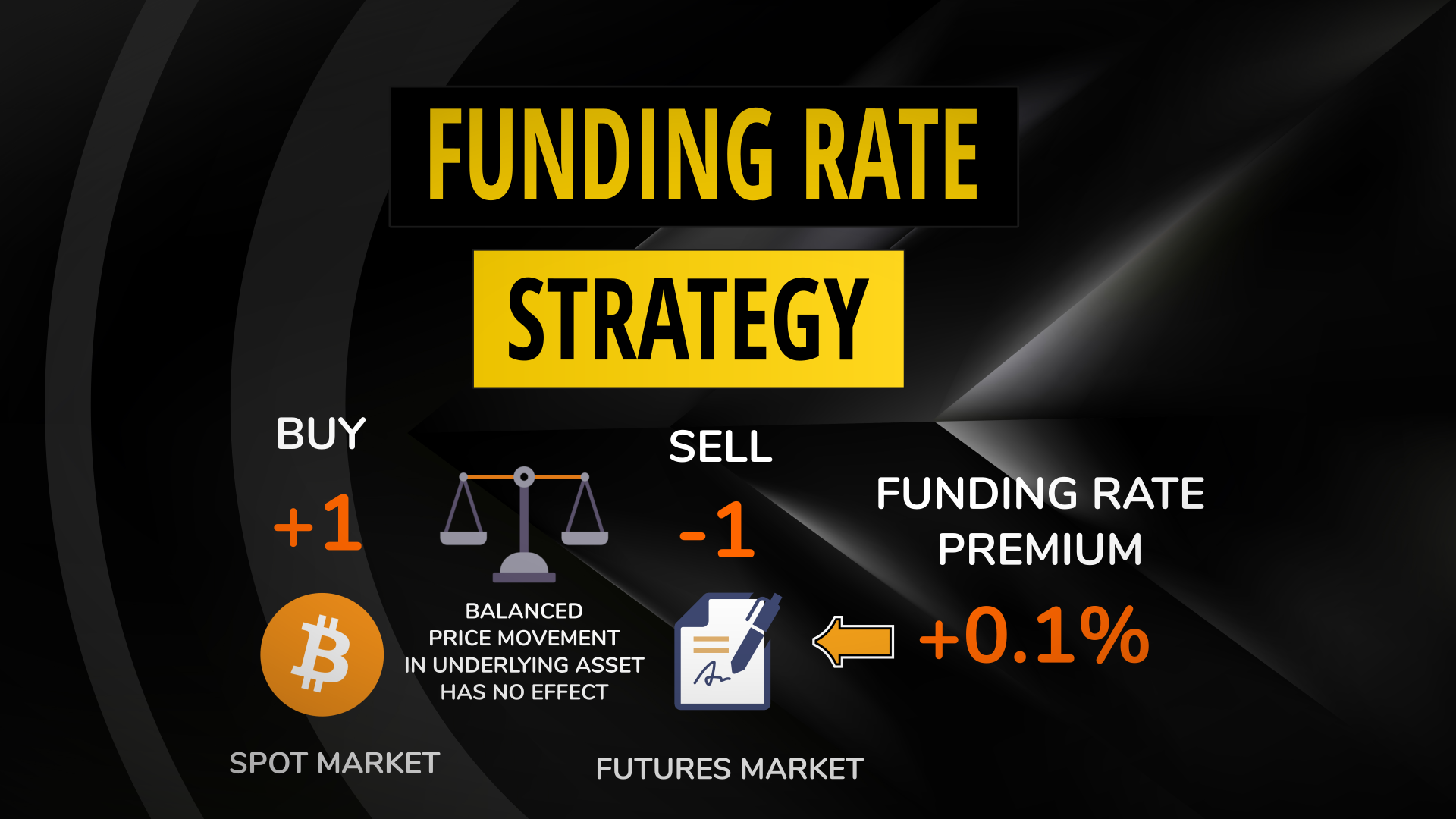

Futures Funding Rate Strategy | Using Binance & FTX To Arbitrage Funding Rates

In this article I’ll be executing a cash and carry trade purchasing a crypto asset on spot markets and short selling a futures contract for the same asset to collect funding rate fees. Understanding Futures Contracts A futures contract tracks the price of an underlying asset. It allows active traders to take out a long…

-

Pine Script Tutorial | How To Develop Real Trading Strategies On TradingView

In this pine script tutorial I’ll be showing you how to get started with TradingView scripting for technical analysis and trading strategy development. We will start by looking at how pine script works and a simple example. From there we will move on to inputs and indicators before creating a complete trading strategy using pine…

-

Binance vs FTX | Which Is The Best Crypto Exchange?

Update November 2022. Binance is the best exchange. In this article I’ll explore the differences between Binance vs FTX to find out what each offers and which you should be using. I’ll be assessing a number of factors such as markets, liquidity, security, fees, user interface and API’s. Binance vs FTX [Video] James On YouTube…

-

Wallstreetbets vs Hedge Funds

An epic battle is currently breaking out between a rapidly growing Reddit community Wallstreetbets vs Hedge Funds. James On YouTube For those who don’t know Wallstreetbets is a subreddit which is dedicated to proudly “treating the stock market as a casino”. It is generally not safe for work and describes itself as 4Chan with a…