Finance

-

Tokenizing Real World Assets: A How To Guide For Bringing Funds On Chain

Eventually the vast majority of liquid assets will be tokenized to enable digital ownership. The world is moving in this direction because the technology is already in place. For sophisticated investors and financial institutions, the next frontier in capital markets is the tokenization of Real World Assets (RWAs). This process converts tangible and intangible assets…

-

The Alchemy Of Finance Summary – George Soros

George Soros challenges the foundational assumptions of modern financial theory in “The Alchemy of Finance,” presenting his revolutionary theory of reflexivity that fundamentally reframes how markets operate. Rather than accepting the efficient market hypothesis that dominates academic finance, Soros argues that financial markets are inherently unstable and driven by the bidirectional relationship between market participants’…

-

GPT5 on the next 10 years

The Next Decade, Rewired: Power, Compute, and the New Geography of Advantage (2025–2035) Date: August 2025 – full prompt at the end By 2035, the decisive constraint on growth will shift from capital and data to power and permission. AI will commoditize knowledge work faster than markets expect, but the bottlenecks and outsized returns will…

-

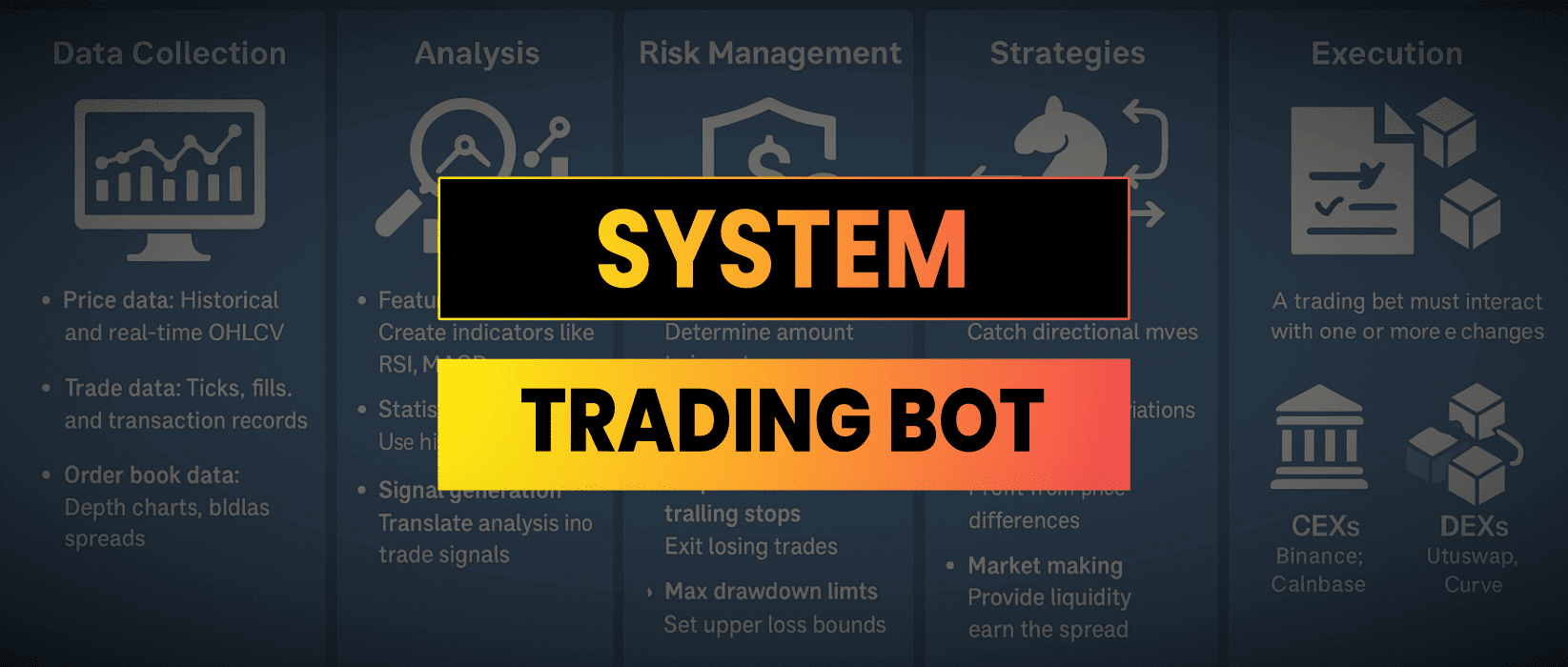

System Trading Bot Design Breakdown

In this post I’m going to breakdown the different parts of a system trading bot that I built to execute trend following and mean reversion strategies. There’s a short video here if you prefer a quick walkthrough: https://youtube.com/shorts/3tWl4ETbqTw Building a robust and profitable system trading bot requires careful planning, solid architecture, and a deep understanding…

-

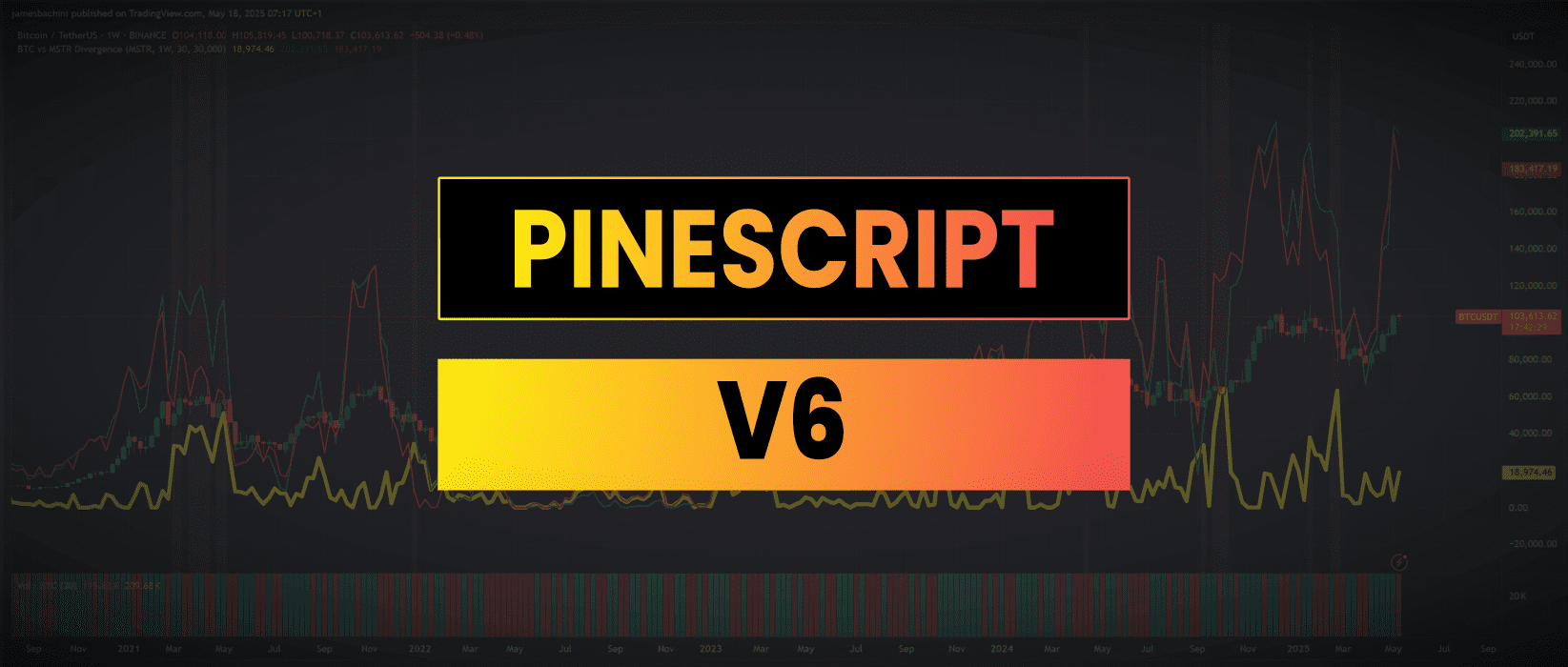

Pine Script v6 For Tradingview: How I Created An Indicator To Find Bitcoin/Microstrategy Divergences

Pine Script v6 has just been released and whether you have never created a TradingView indicator before or you are a Pinemaster, there’s something in here for everyone. James On YouTube Watch On YouTube: https://youtu.be/6XOTQ4OP-dE | Subscribe Let’s start by exploring the upgrade and new features, then we’ll jump into writing some code using the…

-

Crypto Market Thesis 2025

It’s that time of the year again, I have published my thoughts and musings on the blockchain sector in the annual crypto market thesis for 2025. Full document has been published here: https://jamesbachini.com/resources/CryptoMarketThesis2025.pdf Previous years: 2023, 2024 Summary below: 2024 Year in Review Macro Trends Market Outlook for 2025 Sector Insights Emerging Trends to Monitor…

-

How Often Should I Rebalance My Portfolio

In this tutorial I modelled the optimal rebalancing frequency for a digital asset portfolio holding: This is a 60/40 crypto portfolio which I’ve discussed before. You can run the code with different assets (anything with a historical price feed). Starting with a $10,000 initial investment, the code allocates the funds accordingly and tracks performance over…

-

Why Inflows Into Spot Bitcoin ETFs Don’t Push Prices Up

The Bitcoin Spot ETFs are a gateway for institutional inflows into Bitcoin, potentially driving up prices. However, on the 29th and 30th October over $1.763 Billion USD flowed into the Bitcoin ETFs*. During this period the BTC/USD price barely moved. Here’s a closer look at why spot Bitcoin ETF inflows don’t always translate into an…

-

Incorporating Bitcoin In A Treasury Strategy

Cash Savings in Treasuries Treasury managers face a significant challenge in preserving the value of their reserves. Traditional cash savings, once considered a safe haven, have become increasingly unsuitable for long-term corporate savings. This shift is primarily due to the ongoing dilution caused by money supply growth, as central banks worldwide engage in quantitative easing…

-

Calculating CAGR in Python & JavaScript

The Compound Annual Growth Rate (CAGR) is a useful measure for assessing the mean annual growth rate of an investment or business metric over a specified period longer than one year. Unlike other growth metrics, CAGR smooths out the volatility, providing a clearer picture of how investments grow over time. In this guide, I’ll show…

-

Using ChatGPT To Explore Future Investment Opportunities

This post was inspired by @Jake_Pahors post on Twitter which led me down a rabbit hole of thinking about what the world might look like in 10 years time and what investment opportunities might arise from these changes. The first step was to get ChatGPT to check what I was missing using the following prompt.…

-

Investment Thesis for Alibaba Group (BABA)

I first became addicted to eBay a couple of decades ago, over time I started ordering more and more on Amazon, I’ve now found myself ordering more on AliExpress and having items shipped directly from China. During the Euros (soccer tournament) AliExpress was one of the main sponsors which got me thinking that this trend…

-

DeDollarisation In The Changing World Order

What if the world’s most dominant currency, the US dollar, is losing its grip on global power? De-dollarisation is a seismic economic shift that could reshape the global financial landscape as we know it. Imagine a future where the dollar’s influence wanes and emerging currencies, backed by hard assets rise to prominence. This change will…

-

Structured Products DeFi

We all remember the 2008 financial crisis, a global upheaval sparked in part by complex structured products like collateralised debt obligations. These financial instruments are still widely used in traditional finance to manage risk and enhance returns. But what if we could reimagine these products in DeFi? In this article, we’ll explore how decentralised structured…

-

Apple Tap To Cash

Apple’s WWDC 2024 keynote unveiled Tap to Cash to simplify p2p payments, simply tap one iPhone to another to send money via Apple’s wallet. Why should you care about a minor tech upgrade from Apple? Because this one could be the first step towards a wider change in how we handle personal transactions. Dive in…

-

Interest Rates, FOMC & Crypto

Ever wondered why crypto traders are obsessed with FOMC meetings and what the Federal Reserve are planning next? Interest rates set by the Fed impact the price of Bitcoin and other digital assets alongside stocks, shares and bonds. What if you could anticipate long-term price movements just by understanding a few macro economic principles? Let…

-

Crypto Market Thesis 2024

The crypto market has experienced significant recovery this year, with Bitcoin’s value surging from $16,500 to over $40,000. Growth was shadowed by increased regulatory scrutiny, particularly impacting centralized exchanges. The Bitcoin halving in April 2024 is poised to be a pivotal event, historically triggering market rallies. The potential January approval of Bitcoin spot ETFs could…

-

Nixon Shock | The Beginning Of The End

In a bold and controversial move in 1971, U.S. President Richard Nixon instigated what is now known as the “Nixon Shock“ Faced with soaring inflation, Nixon implemented drastic measures including wage and price controls, import surcharges, and ending the U.S. dollar’s gold convertibility. This move effectively dismantled the Bretton Woods system, an international monetary framework…

-

How I Built A Smart Money List On Twitter

X formerly known as Twitter includes two features which allows us to create a list of accounts from people that frontrun narratives and successful trades. tl;dr if you just want to see the final list it is here: https://twitter.com/i/lists/1712044491618545903 James On YouTube Watch On YouTube: https://youtu.be/4qYraarbsYs |Subscribe Step 1. Collecting Project Data My main focus…

-

Value Averaging vs Dollar Cost Averaging

One of the most recognized techniques for investing is dollar cost averaging. A process where you invest equal amounts over set periods i.e. $100/month. A less well known strategy is value averaging which when compared across multiple markets and time frames is more effective. In this article I discuss the concept of value averaging, the…

-

A Close Look at PYUSD | Implications Of The PayPal Stablecoin

In August 2023 Paypal unveiled their new stablecoin, an ERC20 token built on Ethereum. The code is open source, the contract is verified on Etherscan, it’s a real token which is going to be available to Paypal’s 435m users. What Is pyUSD & How Does It Work The Paypal stablecoin was developed in partnership with…

-

Crypto Travel Rule | Creating A Surveillance State

From the 1st September 2023 the crypto travel rule will come into force in the UK, the EU is holding a grace period with plans to bring it in towards the end of 2024 and it’s already in place in the US, Canada and other parts of the globe. What Is The Crypto Travel Rule…

-

Tokenized US Treasuries | Ondo Finance vs MatrixDock

Tokenized US treasuries offer a yield on stablecoin holdings and with rising interest rates they are quickly gaining traction in DeFi markets. In this article I want to look at two projects to see how they compare and how the real world asset ecosystem is shaping up. Real World Assets In the last six months…

-

XRP Legal Case | What It Means For Developers

In this article I’m going to be breaking down the document filed by judge Torres yesterday and consider what it means to developers working in the blockchain and web3 space. Highlights From The Ruling The full document is available here:https://www.nysd.uscourts.gov/sites/default/files/2023-07/SEC%20vs%20Ripple%207-13-23.pdf I’ve picked out some highlights Programmatic SalesHaving considered the economic reality of the Programmatic Sales,…

-

3 Ways To Raise Web3 Funding

In this article I’ll explore 3 ways in which you can raise funds for your project with web3 products. Membership NFT A NFT is a non-fungible token, they are often represented as a unique image which can contain additional rights such as: To execute a NFT drop, the following steps can be taken: If any…

-

FTX 2.0 ReLaunch

FTX 2.0 is a proposed relaunch of the cryptocurrency exchange FTX.com, which filed for bankruptcy in November 2022. The FTX exchange was a profitable business, earning a small percentage from trading fees. However depositors funds were used to cover up losses from partner trading firm Alameda Research. Alameda also provided market maker services across all…

-

Can London Become A Crypto Hub?

Earlier this week one of Silicon Valley’s largest VC firms Andreessen Horowitz announced it would be opening an office in London for their a16zCrypto arm. In this article we will look at how well positioned the UK is relative to the rest of the world to become a fintech capital and hub for the blockchain…

-

Raising Funds For Your Blockchain Project

For founders looking to raise capital there are a number of options which we will explore in this article. Private Round A private round is where a founder will outreach and pitch their concept to investors in the space. For raises under $100k angel investors can provide initial funding to get a project started. For…

-

Is My Token A Security? The Howey Test For Digital Assets

The SEC & Securities Regulations The Securities and Exchange Commission (SEC) is an independent agency of the United States federal government that is responsible for regulating securities and protecting investors. In practice they have done more to protect Wall Steet financial institutions than they have ever done for individual investors. The SEC regulates securities through…

-

Uniswap Market Maker Bot | Managing Token Liquidity On Uniswap

In this tutorial I am going to go through how I built a market maker bot to manage liquidity on Uniswap v3 for a token pair. The idea is to create a automated trading bot which buys tokens when price falls below a base line value and sells tokens when price is above the base…

-

Trading The Lifecycle Of Crypto Narratives

The blockchain sector moves fast and attention shifts rapidly as crypto narratives emerge inflating valuations for sub-sectors before moving on to the next big thing. In this article I’m going to outlay my research into the lifecycle of crypto narratives to explore how we can best position our portfolios and allocate funds in a +EV…

-

Technical Analysis For Crypto Degenerates

For cynics technical analysis is seen as astrology for middle aged white guys for others it is the holy grail, which when mastered, inevitably leads to trading success. The truth is somewhere in the middle, it is undeniable that price action reacts more at some levels than others. It’s important for anyone involved in investing…

-

Web3 Investment Thesis

This Web3 investment thesis covers the potential disruption from decentralized permissionless computing. As blockchains scale it’s going to be possible to use smart contracts to enable users to store their own data creating the opportunity for a new era of decentralized applications. Web3 Disrupting Data Web3 disrupts the way we store data online by using…

-

Private Funding vs Public Funding Rounds | How To Raise Capital In Crypto

Since the 2018 ICO bust, venture capital funding has become the primary avenue for blockchain startups to raise money. This comes with pros & cons which we will explore in this article alongside how raising capital works in the blockchain sector. How Private Funding Rounds Work During a private funding round the founders of a…

-

Blockchain Jobs | A Definitive List Of Roles & Salaries In Crypto

With the growing popularity of digital assets and decentralized finance, blockchain jobs are becoming increasingly lucrative and desirable. If you’re looking for a career with the potential for innovation, challenge, and outstanding opportunity, this list will guide you though the different jobs in the blockchain sector and what to expect. Executive Blockchain Jobs The founders…

-

Crypto Market Thesis 2023

Once viewed as a fringe market for tech-savvy libertarians, the crypto market has grown exponentially in recent years and is now being recognized as a legitimate asset class by mainstream investors. As we move into 2023, the crypto market is at a crucial juncture, with the potential to continue its explosive growth or face regulatory…

-

The Psychology Of Money | Book Summary

The Psychology of Money by Morgan Housel covers personal finance from the perspective of a middle aged American value investor. It offers some interesting insights into long-term investing mindsets and the psychology of why we make investment decisions. Evolution of Personal Finance Western economies have seen a transition in the way we work from manual…

-

FTX Collapse Explained | The Story Of Scam Bankrun Fraud

In November 2022 the world’s second largest cryptocurrency exchange FTX collapsed, stopped withdrawals and filed for bankruptcy. The stories of the last week are so far-fetched they deserve a Netflix documentary. Here we will look at how FTX was able to defraud the crypto industry of somewhere in the region of $10 Billion US dollars.…

-

The State Of CBDC Central Bank Digital Currency

Nation states across the world are exploring CBDC’s (central bank digital currency). Many governments including France, Canada, Saudi Arabia & China have pilot schemes already in place. The US dollar is the global reserve currency, it’s used throughout the world as a base asset and more recently as a political weapon in the form of…

-

Bear Markets | How Human Psychology Works Against Us

Is loss aversion causing long-term underperformance in our portfolios? In bear markets I find it harder to rebalance my portfolio and allocate capital to riskier investments. This creates an unintentional de-risking in bear markets where there is a better long-term risk to reward. James On YouTube Watch On YouTube: https://youtu.be/6F1Cpk14stE |Subscribe Not a financial advisor,…

-

Curve Wars | The Best Way To Gain Exposure To The Curve Wars

A battle rages for control of DeFi’s biggest protocol as stablecoins fight for liquidity. Million dollar bribes being paid for votes, enemies becoming alliances and an ultimate prize at stake. This article explores why CRV is so valuable and why it likely isn’t the best way to gain exposure to the Curve wars. The CRV…

-

Crypto Market Thesis 2022 & Current Portfolio Holdings

This article outlines my thoughts and predictions for crypto markets heading in to 2022. At the end of the article I share my allocations and plans for this year. Crypto Market Thesis Video James On YouTube Watch On YouTube: https://youtu.be/ogBcbwuasWw Bitcoin Market Outlook Crypto markets have cooled off significantly since summer 2021 but expectations are…

-

Bitcoin ETF | Why A Bitcoin ETF Changes Everything

On Tuesday 3rd August the head of the SEC gave the clearest signal yet that they are readying for the approval of the growing list of Bitcoin ETF products awaiting regulatory approval. “I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded Bitcoin futures” Gary Gensler @…