Analysis

-

Aztec Network Token Sale: Deep Investment Analysis Report

I used a combination of LLM’s (Gemini3, Grok4 & OpenAI 5.1) to create a deep research report for the Aztec network token sale which starts December 2nd. Sharing below and PDF available. Note this is provided as is and has not been fact checked or edited. Not financial advice, do your own research. Aztec Network…

-

The Stellar 2025 Roadmap

The Stellar Development Foundation has released it’s roadmap for 2025 and if you’re a developer or a user in the Stellar ecosystem, here is what you should know. The focus has shifted to scaling what works and making the whole system more usable, accessible, and ready for decentralized finance and web3 adoption. “After a decade…

-

Stellar Soroban Alerts With OpenZeppelin Monitor

In this tutorial we will be setting up the OpenZeppelin monitor and creating a custom monitor to get alerts on large USDC transfers and send them to a Telegram chat. James On YouTube Watch On YouTube: https://youtu.be/9ebmeGu1LmE | Subscribe To follow along you’ll need Rust installed. Let’s start by forking and building the repository: The…

-

Pine Script v6 For Tradingview: How I Created An Indicator To Find Bitcoin/Microstrategy Divergences

Pine Script v6 has just been released and whether you have never created a TradingView indicator before or you are a Pinemaster, there’s something in here for everyone. James On YouTube Watch On YouTube: https://youtu.be/6XOTQ4OP-dE | Subscribe Let’s start by exploring the upgrade and new features, then we’ll jump into writing some code using the…

-

Ethereum Pectra Upgrade Imminent

The upcoming Pectra upgrade, scheduled for March 2025, aims to make ethereum more efficient and lay the ground work for further scaling and development. Pectra is a significant update that merges two planned upgrades, Prague and Electra, into one comprehensive overhaul. This combined effort is designed to streamline improvements and accelerate Ethereum’s evolution. Account Abstraction…

-

Using ChatGPT To Monitor The Silk Road Bitcoin

In this video I demonstrate how to monitor a Bitcoin address using NodeJS James On YouTube Watch On YouTube: https://youtu.be/rZ5TnPkO86Y | Subscribe Here is a quick script (full code below) that was knocked up using chatGPT to play an mp3 alert file if any Bitcoin moves from the SilkRoad address. I set this up because…

-

Crypto Market Thesis 2025

It’s that time of the year again, I have published my thoughts and musings on the blockchain sector in the annual crypto market thesis for 2025. Full document has been published here: https://jamesbachini.com/resources/CryptoMarketThesis2025.pdf Previous years: 2023, 2024 Summary below: 2024 Year in Review Macro Trends Market Outlook for 2025 Sector Insights Emerging Trends to Monitor…

-

The Hidden Deflation of Digital Assets

The Inevitable Loss Facing Early Cryptocurrency Hodlers Substantial amounts of digital assets are going to be lost forever over the next few decades. The first generation of crypto hodlers will be dying off and many of their holdings will die with them. These losses, often caused by misplaced private keys or forgotten passwords, add an…

-

How Often Should I Rebalance My Portfolio

In this tutorial I modelled the optimal rebalancing frequency for a digital asset portfolio holding: This is a 60/40 crypto portfolio which I’ve discussed before. You can run the code with different assets (anything with a historical price feed). Starting with a $10,000 initial investment, the code allocates the funds accordingly and tracks performance over…

-

Why Inflows Into Spot Bitcoin ETFs Don’t Push Prices Up

The Bitcoin Spot ETFs are a gateway for institutional inflows into Bitcoin, potentially driving up prices. However, on the 29th and 30th October over $1.763 Billion USD flowed into the Bitcoin ETFs*. During this period the BTC/USD price barely moved. Here’s a closer look at why spot Bitcoin ETF inflows don’t always translate into an…

-

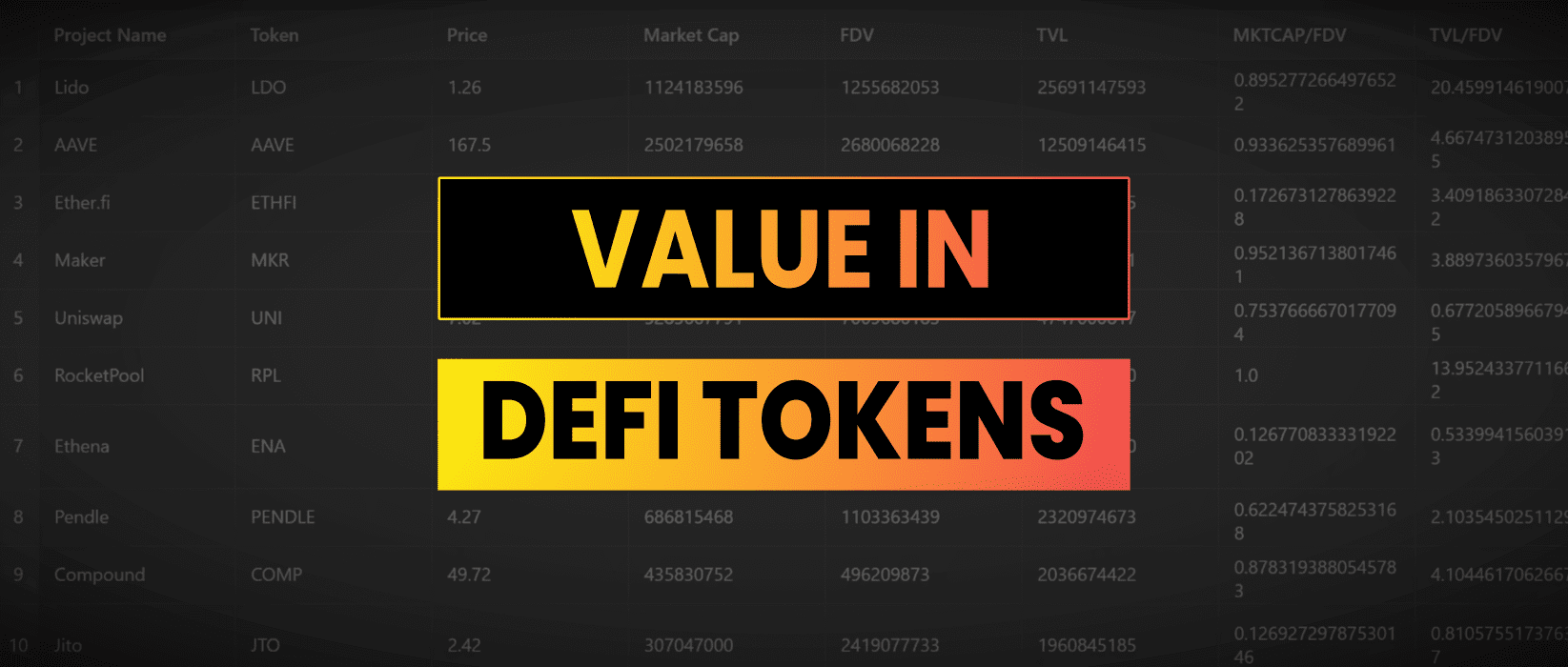

Value Investing In DeFi

For value investors the goal is to find assets priced below their intrinsic value, providing a margin of safety and potential for significant future growth. Could applying this principle to DeFi help identify underappreciated projects that are gaining significant traction. Let’s find out… Market Cap, TVL & FDV Market capitalization is the total value of…

-

Calculating CAGR in Python & JavaScript

The Compound Annual Growth Rate (CAGR) is a useful measure for assessing the mean annual growth rate of an investment or business metric over a specified period longer than one year. Unlike other growth metrics, CAGR smooths out the volatility, providing a clearer picture of how investments grow over time. In this guide, I’ll show…

-

DeFi Whale Watching Tutorial & Code

Imagine if you could tap into the strategies of top investors and see where the smart money is allocating capital? Welcome to the world of DeFi whale watching, where tracking high net worth wallets can give you the edge and open up new Whale Watching Explained DeFi whale watching involves tracking the investments of “smart…

-

Structured Products DeFi

We all remember the 2008 financial crisis, a global upheaval sparked in part by complex structured products like collateralised debt obligations. These financial instruments are still widely used in traditional finance to manage risk and enhance returns. But what if we could reimagine these products in DeFi? In this article, we’ll explore how decentralised structured…

-

The Ethereum Pectra Upgrade

Imagine your everyday Ethereum account could temporarily transform into a powerful smart contract wallet. This is exactly what EIP-7702, a core part of the Pectra upgrade, promises. This new feature will allow normal Ethereum account addresses (EOAs) to act as smart contracts during transactions, only to revert to their original state afterwards. This upgrade has…

-

Interest Rates, FOMC & Crypto

Ever wondered why crypto traders are obsessed with FOMC meetings and what the Federal Reserve are planning next? Interest rates set by the Fed impact the price of Bitcoin and other digital assets alongside stocks, shares and bonds. What if you could anticipate long-term price movements just by understanding a few macro economic principles? Let…

-

Frontrunning Crypto Catalysts For Fun & Profit

There is opportunity in crypto markets if you can get ahead of the next narrative and allocate capital prior to mass of market participants. Staying ahead of the curve often means keeping an eye on emerging trends and strategic moves that can significantly impact a project’s market perception and value. In this article I’m going…

-

Ethena USDe | DeFi Analysis Report

Ethena Labs has introduced USDe, a synthetic dollar on the Ethereum blockchain. USDe is designed to be crypto native, stable and censorship resistant. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Ethena or USDe at time of writing. Do your…

-

Starknet STRK Tokenomics

Starknet is a layer 2 zero knowledge rollup which uses a STARK cryptographic proof and Cairo based smart contracts. A few days ago they released the STRK token and in this article I’ll dive in to the tokenomics. Currently at time of writing the token trades at $1.91 and has a $1.39 billion dollar circulating…

-

Aggregated Blockchains and Polygon’s Agglayer

Polygon is gearing up to launch its AggLayer v1 mainnet with an event later today at 14:00 UTC Feb 23rd “Aggregation Day 2024”. In this article I’ll look at what aggregated blockchains are and how Polygon’s Agglayer works. What Are Aggregated Blockchains? The idea of aggregated Blockchains is to facilitate developers in bridging different blockchains…

-

LRTs | Liquid Restaking Tokens

I’ve previously discussed Eigenlayer and how restaking works but let’s look at what this will look like for the majority of users. Liquid Restaking Tokens are the equivalent of stETH for restaking where users can deposit assets to gain exposure to yield from restaking using a simple ERC20 token. This is a write up of…

-

Crypto Market Thesis 2024

The crypto market has experienced significant recovery this year, with Bitcoin’s value surging from $16,500 to over $40,000. Growth was shadowed by increased regulatory scrutiny, particularly impacting centralized exchanges. The Bitcoin halving in April 2024 is poised to be a pivotal event, historically triggering market rallies. The potential January approval of Bitcoin spot ETFs could…

-

ATOM Cosmos Analysis | A Deep Dive Into The Cosmos Ecosystem

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ATOM at time of writing. Do your own research, not investment advice. What Is Cosmos Cosmos is a decentralized layer zero network of independent blockchains, designed to enable scalability and interoperability between…

-

GEAR Gearbox Protocol | DeFi Analysis Report

Gearbox Protocol introduces a framework for both passive lenders and active borrowers. It empowers traders with leverage that can be used to scale up trades and yield farming strategies on decentralized exchanges such as Unsiswap and Curve. With an emphasis on composable leverage, zero funding rates, and permissionless strategies, Gearbox Protocol is an compelling microcap…

-

Asymmetry Finance | DeFi Analysis Report

Asymmetry Finance has emerged as a significant player in the liquid staking wars, offering an aggregated liquid staking token. This article explores the core functionalities of Asymmetry Finance and its core product safETH. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure…

-

eBTC How To Trade The Flippening

eBTC is an over-collateralized digital asset pegged to the price of Bitcoin which can be minted using stETH as collateral. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to eBTC at time of writing. Do your own research, not investment advice.…

-

MUX Protocol | DeFi Analysis Report

MUX is a decentralized trading platform offering slippage free trades and 100x leverage. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to MUX at time of writing. Do your own research, not investment advice. The first thing that jumps out about…

-

Brine Finance | DeFi Analysis Report

Brine Finance is a decentralized orderbook exchange built on Starkware. They recently raised $16.5m at a valuation of $100m in a round led by Pantera Capital. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Brine at time of writing. Do…

-

Radix DLT | DeFI Analysis Report

Radix is a layer one blockchain which has recently gone live on mainnet enabling developers to deploy scrypto smart contracts. In this report I’ll explore the novelties of the technology, dive into the scrypto programming language, look at the excellent developer resources, analyze the tokenomics of the native XRD token and draw a conclusion on…

-

HyperLiquid | Decentralized Perpetual Futures Trading

Hyperliquid is a decentralized exchange that specializes in perpetual futures contracts. It’s seen modest growth through a difficult bear market and has a frontend remarkably similar to FTX. Let’s dive in. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to HyperLiquid…

-

VEGA DeFi Derivatives Protocol | DeFi Analysis Report 🔍

VEGA is a dedicated appChain built for decentralized derivatives such as futures and options contracts. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to VEGA at time of writing. Do your own research, not investment advice. Vega is a infrastructure layer…

-

Smol dApp | MultiSafe MultiChain MultiSig Wallets

Smol dApp is like a swiss army knife of useful tools for DeFi. Their main offerings are: The product we are going to look at todays is their flagship MultiSafe wallets. This is a GnosisSafeProxy contract which requires a set number of wallets to sign off on a transaction before it goes through. For example…

-

Spark Protocol sDAI | DeFi Analysis Report

Does earning 8% on your DAI stablecoin holdings sound too good to be true? Let’s take a look at how Spark Protocol is offering this APR using MarkerDAO’s Enhanced Dai Savings Rate system. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any…

-

Tokenized US Treasuries | Ondo Finance vs MatrixDock

Tokenized US treasuries offer a yield on stablecoin holdings and with rising interest rates they are quickly gaining traction in DeFi markets. In this article I want to look at two projects to see how they compare and how the real world asset ecosystem is shaping up. Real World Assets In the last six months…

-

Hop Exchange | DeFi Analysis Report

Hop Exchange is a bridging protocol that facilitates cross-chain token transfers by utilizing a network of bonders. I first heard it mentioned in a keynote by Vitalik at ethGlobal Waterloo. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Hop…

-

ETHx Stader Labs | DeFi Analysis Report

ETHx from Stader Labs is a solution committed to decentralization and keeping Ethereum accessible, reliable, and rewarding. Having just launched ETH stakers earn 1.5x staking rewards and $800,000 in DeFi incentives across various protocols for the first month. This is a write up of my internal research notes, this is not a sponsored post and…

-

Conic Finance | DeFi Analysis Report

The latest development in the Curve Wars is the establishment of a new player. Conic Finance is gaining traction and becoming a significant player in the stable swap ecosystem. This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of…

-

crvUSD Curve Stable | DeFi Analysis Report

Curve finance recently launched their own stablecoin crvUSD. I was lucky enough to meet one of the developers working on crvUSD at ethDenver and have been impressed with the product and how it has been rolled out. It is an algorithmic stablecoin with massive potential backed by one of the biggest names in DeFi, let’s…

-

Raft Finance | DeFi Analysis Report

This DeFi analysis report for Raft Finance follows up on my analysis and investment in Lybra Finance. This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of writing to Raft or the R stablecoin. Do your own research, not…

-

Lybra Finance | DeFi Analysis Report

Lybra Finance allows stETH stakers to mint the eUSD stablecoin which has a 7.2% APY. This is a write up of my internal research notes, this is not a sponsored post however I have purchased an allocation of LBR Lybra Finance’s governance token in my personal portfolio. Do your own research, not investment advice. Update…

-

Prisma Finance | acUSD an LST backed stablecoin

Prisma Finance is a DeFi project that aims to maximize the potential of Ethereum liquid staking tokens (LSTs). It introduces a stablecoin called acUSD, which is over collateralized by liquid staking tokens. The stablecoin is designed to be capital-efficient and offers additional incentives through integration with Curve and Convex Finance. This is a write up…

-

Alchemix Self-Repaying Loans

Imagine a financial system where your loans automatically pay themselves off, interest-free and without the need for monthly repayments. Alchemix is a synthetic asset protocol run by community DAO. This is a write up of my research notes and is not sponsored in any way. I currently at time of writing have no stake in…

-

RDNT v2 Radiant Capital | DeFi Analysis Report

Earlier this year Radiant Capital launched Radiant v2, an omnichain lending protocol. This is a write up of my internal research notes, this is not a sponsored post and I have no allocation at time of writing in Radiant or RDNT. Radiant is a DeFi platform that allows users to lend and borrow digital assets…

-

Frax Finance | DeFi Analysis Report

Frax is a growing ecosystem of DeFi products built on Ethereum. This is a write up of my internal research notes, this is not a sponsored post and I have no stake currently in Frax or FXS. What Is Frax? Founded in 2019 by Jason Huan, Sam Kazemian & Travis Moore. Frax has a legal…

-

EigenLayer | DeFi Analysis Report

EigenLayer is a protocol which allows Ethereum stakers to restake their ETH. This is a write up of my internal research notes, this is not a sponsored post and I have no stake currently in EigenLayer. EigenLayer is being developed by EigenLabs which is headed by CEO Sreeram Kannan. Sreeram has an academic background and…

-

Renegade Dark Pool DEX

Renegade is a new type of decentralized exchange that utilizes a dark pool to provide MEV resistant private transactions. This is a write up of my personal research, is not a sponsored post and I currently hold no stake in Renegade. What Is Renegade? The Renegade whitepaper was authored by Christopher Bender and Joseph Kraut.…

-

Timeswap v2 AMM Money Market | DeFi Analysis Report

Ricsson Ngo took inspiration from Uniswap and set out to build a permissionless money market. The idea evolved into Timeswap which recently launched on Arbitrum. In this article I’ll write up my own notes and internal research on the protocol. Note this is not a sponsored post and I don’t currently hold any stake in…

-

Mean Finance | How To DCA With DeFi

Mean Finance is a DeFi protocol that enables users to dollar cost average (DCA) into a position for an ERC-20 token. In this article we will look at why dollar cost averaging is useful and how Mean Finance works. Why Dollar Cost Average Dollar cost averaging is an investment strategy that simply breaks a entry…

-

RAILGUN 2.0 | ZK Privacy Protocol

Railgun just announced the launch of version 2.0 this week and in this article we are going to explore the zero knowledge wallet and discuss why privacy protocols are important. In August 2022 Alexey Pertsev was arrested and he has been imprisoned without trial ever since. He was a developer on a ZK mixer called…

-

Yield Futures With Resonate Finance

Resonate Finance is building a protocol for the creation and sale of yield futures. In this article we will look at what yield futures are, how they can benefit a projects tokenomics & why investors might find them attractive. This post isn’t sponsored and I currently have no stake in Resonate Finance or Revest at…

-

Understanding Squeeth | A Token To Track ETH² From Opyn

Squared ETH or Squeeth is a perpetual options protocol that provides unlimited upside leverage with no liquidations on long positions. Squeeth isn’t just a tool for traders, it can be used as a hedge for liquidity providers on Uniswap and it can provide a funding rate yield in sideways markets. This article starts at the…

-

Curve Wars | The Best Way To Gain Exposure To The Curve Wars

A battle rages for control of DeFi’s biggest protocol as stablecoins fight for liquidity. Million dollar bribes being paid for votes, enemies becoming alliances and an ultimate prize at stake. This article explores why CRV is so valuable and why it likely isn’t the best way to gain exposure to the Curve wars. The CRV…