Cryptocurrency

-

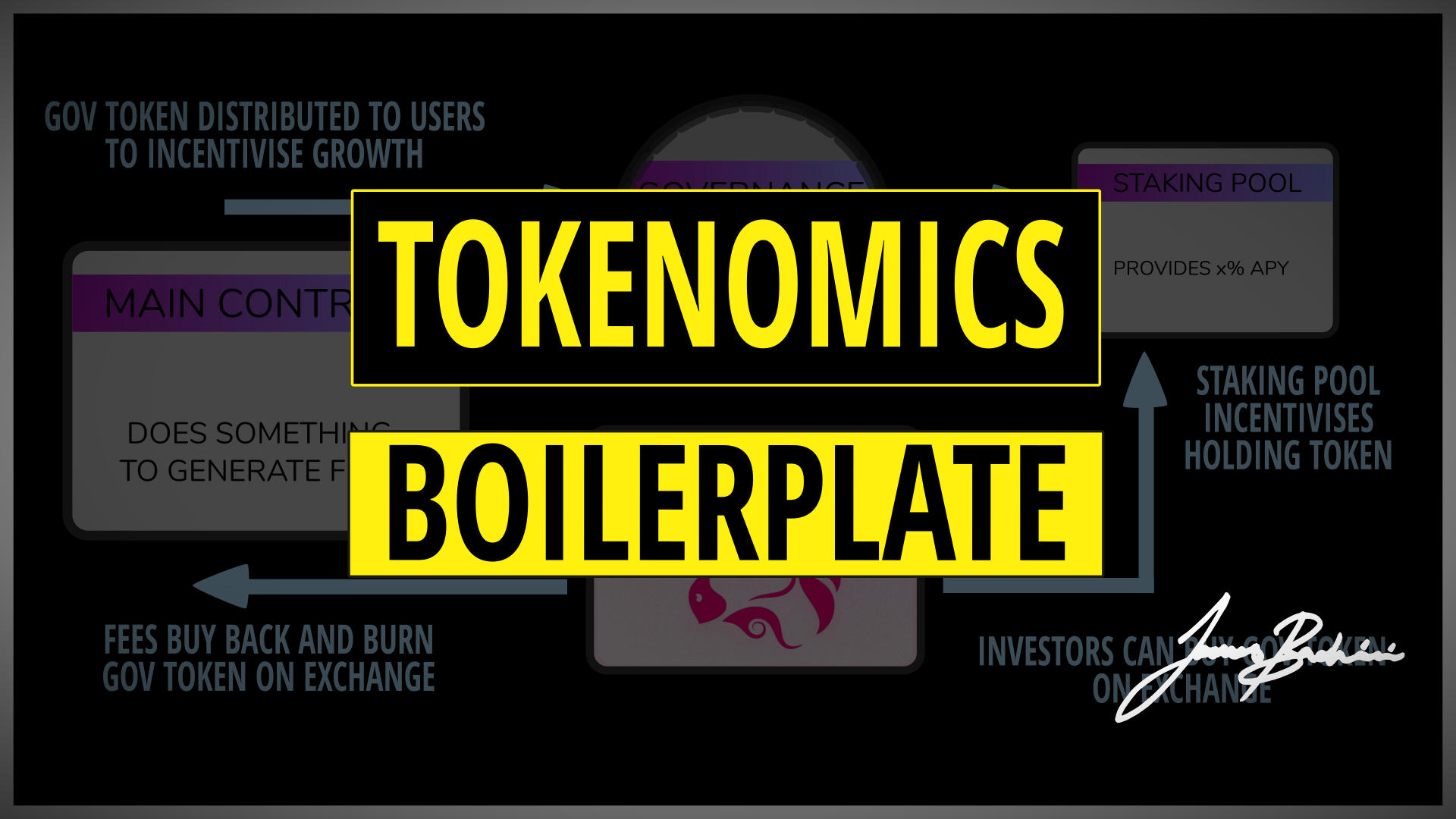

Tokenomics Boilerplate | Governance Tokens, Uniswap Buy-Backs and Staking in Solidity

In DeFi a projects success is greatly tied to the effectiveness of the tokenomics. Governance tokens can be distributed to the users to incentivise growth and fees can be used to buy these back on exchange. In this Solidity tutorial we are going to deploy a governance token, a Uniswap v3 liquidity pool, a buy…

-

EthGlobal Hackathon | Winning $4300 And Advice For Future Participants

EthGlobal hackathons are the largest and most prestigious in the blockchain developer space. The February 2022 “Road To Web3” event was focused on the migration from web2 social networks to web3 technologies. Over the weekend around 400 teams built projects using sponsors technology including Polygon, Uniswap, Moralis and Web3Auth. This video talks about the experience…

-

The Rise Of DyDx And Decentralized Trading

In May 2016 Bitmex launched the XBTUSD market, a perpetual futures contract which simplified traders ability to bet on the price of Bitcoin going up or down. Today perps are traded on the major exchanges at higher volumes than the underlying spot assets. DyDx took this concept and packaged it in to a decentralized trading…

-

Introduction To DEX Arbitrage | Intermediate Solidity Tutorial

This Solidity tutorial will provide an introduction to DEX arbitrage with real, working, profitable open-source code. Solidity developers have the ability batch multiple swaps together and if they are not profitable revert the entire transaction only paying the transaction fee. The creation of EVM blockchains which have low transaction fees has created a playground for…

-

How To Trade Crypto | Ultimate Guide To Trading Bitcoin, Ethereum & Altcoins

This ultimate “How To Trade Crypto” guide is provided for educational purposes. I am not a financial advisor, not financial advice. The vast majority of active trading in crypto markets is done on centralized exchanges such as Binance and FTX. The high volumes on perpetual futures on both exchanges has proven the demand for leveraged…

-

How To Automate Yield Farming | Harvesting Rewards With A Quick & Dirty Script

Connect wallet, click button, confirm transaction. It gets old pretty quick, especially when you need to do it daily to compound returns. This tutorial takes you through the process of using a block explorer to find functions, calling those functions from a script and then executing to harvest and stake reward tokens. The aim is…

-

When Will Ethereum 2.0 Launch & The Triple Halving Event

Ethereum 2.0 is the biggest update that the crypto sector has ever seen. A series of rollouts will include a migration to proof of stake, sharding and the highly anticipated triple halving event. This article will discuss the roadmap for these rollouts, what changes each update will implement and the possible effects. Ethereum 2.0 Roadmap…

-

Token Launch Plan | Fair Launch vs Pre-Sale vs ICO vs IDO vs IEO

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance When a new project launches a token it is quite common that they create an initial distribution through a token launch. This article discusses some of the different types of token launches followed by…

-

Crypto Oracles | Moving Data On-Chain

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance Crypto oracles provide an essential bridge between off-chain and on-chain data. If a smart contract needs access to price feeds, random numbers or external data they will need to use an oracle because the…

-

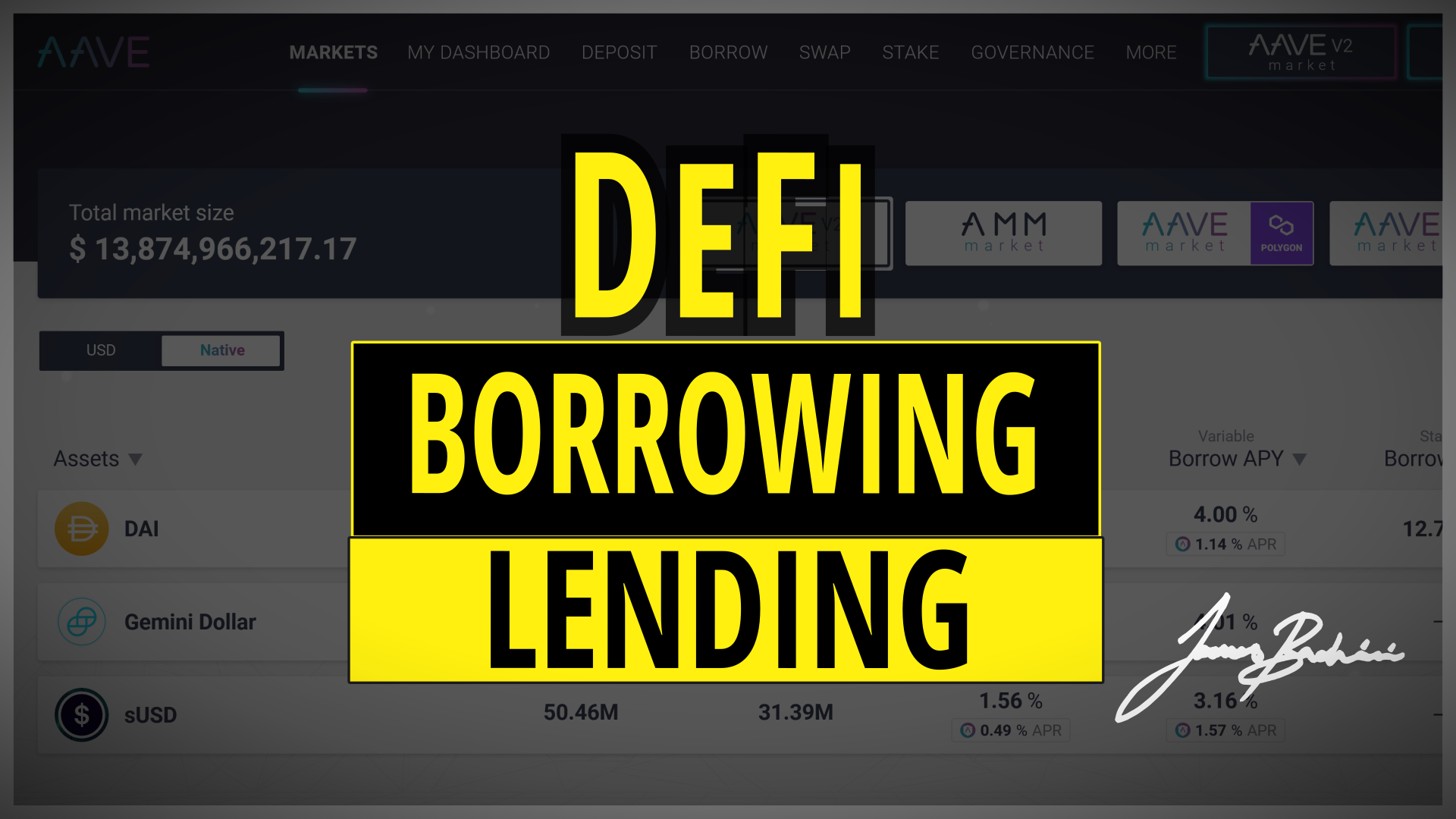

DeFi Borrowing & Lending

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance DeFi borrowing and lending differs from traditional finance where institutions will lend funds based on credit ratings. In DeFi accounts are anonymous, there are no credit ratings to assess risk. Borrowing and lending is…

-

USD Stablecoins Compared | USDT vs USDC vs UST vs MIM vs DAI vs FRAX

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance USD stablecoins have become big business with over $100 billion of collateral locked in USDT and USDC alone. This article dives in to how stablecoins work, the different types and looks at some of…

-

Synthetic Assets | A Regulatory Nightmare

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance Synthetic assets are a form of derivative product in decentralised finance. Synths are created which follow the price of an underlying asset. For example sTSLA will follow the stock price of Tesla and can…

-

The Rise Of Automated Market Makers

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance In late 2017 all the tokens were on Ethereum and it made sense that someone would eventually build a decentralised digital asset exchange. The first popular one was called IDEX and it followed the…

-

The Token Economy

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance The token economy is the accelerating migration of assets into the digital world. One of the first breakthroughs for Ethereum was a smart contract that facilitated the creation and transfer of tokens. Anyone who…

-

The Truth About dApps & Web3

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance If smart contracts form the back end brains of a DeFi platform then dApps or decentralized applications form the front-end that we interact with as users. In theory dApps can be compiled from source…

-

Smart Contracts Simply Explained

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance Decentralized finance is built on smart contracts. The code that enables users to lend, borrow and swap tokens is all run on Ethereum’s virtual machine. Smart contracts are written (mainly) in the language of…

-

History of Cryptocurrency | How Bitcoin & Ethereum Created A Trillion Dollar Asset Class

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance The history of cryptocurrency starts long before Bitcoin. Blockchain’s have been around since the 1980’s and Bitcoin was built not as a totally novel concept but on top of other works like Nick Szabo’s…

-

Understanding Squeeth | A Token To Track ETH² From Opyn

Squared ETH or Squeeth is a perpetual options protocol that provides unlimited upside leverage with no liquidations on long positions. Squeeth isn’t just a tool for traders, it can be used as a hedge for liquidity providers on Uniswap and it can provide a funding rate yield in sideways markets. This article starts at the…

-

Aurora | Near Protocol’s Explosive EVM Blockchain

Money flows in and out of DeFi ecosystems like the changing of the tide. In 2021 fifteen different blockchains exceeded one billion us dollars in total value locked. The early adopters who stay ahead of the money flow tend to make the highest returns. Aurora looks set to become another billion dollar DeFi ecosystem. This…

-

The Truth About Where Yield Comes From In DeFi

Interest rates in traditional banks are 0.1%, have you ever wondered how DeFi yield farmers are getting 20-100% yields on their digital assets? Is it sustainable wealth creation or a giant ponzi that risks collapsing in on itself. That’s the question we are going to explore in this article looking at where yield comes from…

-

How To Make Cross Chain Transfers With Multichain

I’ve seen Anyswap popping up more and more in on-chain analytics reports as it’s grown to be a six billion dollar protocol by TVL. The platform just rebranded to Multichain and its fast becoming the market leader in cross chain bridges. If you want to transfer USDC from Ethereum to Polygon or Fantom or another…

-

Real Bedford FC | The ₿itcoin Football Club Story

Negotiations are finalised. Peter McCormack, host of “What Bitcoin Did” podcast, has agreed to purchase Bedford Football Club. At the end of the season the the club will rebrand to Real Bedford FC and the journey to take Bedford to the premier league will begin. With lucrative sponsorship deals already in place this could just…

-

Curve Wars | The Best Way To Gain Exposure To The Curve Wars

A battle rages for control of DeFi’s biggest protocol as stablecoins fight for liquidity. Million dollar bribes being paid for votes, enemies becoming alliances and an ultimate prize at stake. This article explores why CRV is so valuable and why it likely isn’t the best way to gain exposure to the Curve wars. The CRV…

-

Crypto Market Thesis 2022 & Current Portfolio Holdings

This article outlines my thoughts and predictions for crypto markets heading in to 2022. At the end of the article I share my allocations and plans for this year. Crypto Market Thesis Video James On YouTube Watch On YouTube: https://youtu.be/ogBcbwuasWw Bitcoin Market Outlook Crypto markets have cooled off significantly since summer 2021 but expectations are…

-

Blockchain Developer Roadmap | A Guide To Learning Blockchain Development

This blockchain developer roadmap lays out a framework for learning blockchain development. It should provide a wealth of resources and information for aspiring blockchain developers. Blockchain Developer Roadmap James On YouTube Watch On YouTube: https://youtu.be/h-IcAZX7250 Understanding The Moving Parts There are a number of roles within the blockchain sector and an understanding of what each…

-

Crypto Market Volatility | List Of 100 Altcoin Betas Relative To Bitcoin

In this study we are looking at crypto market volatility and how different altcoins markets move relative to Bitcoin. For example if Bitcoin moves up or down 1% Solana will roughly move double that amount for various reasons discussed below. Crypto Market Volatility List FTX Market Beta Volume BTC-PERP 1.01 $4609m ETH-PERP 1.29 $4471m SOL-PERP…

-

DeFi Risk | A Framework For Assessing & Managing Risk in DeFi

The high yields available in decentralised finance come with a downside. DeFi risk is real and if you are participating in the markets then you should know how to assess and manage that risk. By building a risk assessment framework for yield farms and DeFi opportunities we can better assess fair value and allocate capital…

-

How To Clone Safemoon

In this tutorial I’ll show you how to clone Safemoon and create your own token on Binance Smart Chain. I’m going to do this without any development tools using only a web browser with the metamask plugin. Safemoon is a cryptocurrency token with a function that taxes 10% of all transactions and redistributes 5% to…

-

How Many Bitcoin and Ethereum Are There In Circulation

There can only ever be 21 million Bitcoin ever created. However many are lost, a small fortune lies dormant in the wallets of the mysterious founder Satoshi, and some has been stolen and blacklisted. To calculate the circulating supply of Bitcoin now and in the future we need to take all these factors into consideration…

-

Crypto Index Funds | Set Protocol & Index Coop

This article looks at the future of crypto index funds running on DeFi and in particular the Set Protocol and Index Coop. Crypto index funds known as sets provide a single token which represents a managed or fixed fund of digital assets. Index Funds in TradFi and DeFi In traditional finance index funds are the…

-

How To Short Sell Crypto

Short selling the best asset class of the the last 10 years is a risky venture at the best of times. However there are situations where it can be profitable to get the shorts in while markets or individual token valuations are crashing. In this article I’ll be explaining how to short sell crypto such…

-

Intermediate Solidity Tutorial | Building On DeFi Lego Bricks With Hardhat 👷

In this intermediate solidity tutorial I’ll be building, testing and deploying a smart contract to rebalance a digital asset portfolio. The idea is to look at how we can work with external smart contracts to start building our own products on the lego bricks of DeFi. The Challenge To create a solidity smart contract to…

-

How To Stake Ethereum, Luna or Solana| LIDO Staking Tutorial

As Ethereum moves to a proof of work network it opens up the possibility to stake our assets to gain a yield. We can do this by running our own validator node on the network… or we can use a liquid staking platform. In this lido staking tutorial I’m going to look at the LIDO…

-

112 DeFi Definitions | Blockchain Glossary

The blockchain community has its own language and abbreviations which can seem quite daunting at first glance. Here is a glossary of defi definitions and terms that you’ll want to know and understand to interact in the space. AML (Anti-Money Laundering) Regulations applicable in most international markets aimed at preventing criminal activity. Anti-Money Laundering regulations…

-

Crypto Research | Due Diligence & How To Find The Next 10x Token 🧐

When market conditions are right there are abundant opportunities in seeking out high quality and early stage crypto projects. In this post I’ll walk-through my crypto research process from screening and researching crypto projects to due diligence and tokenomics. An Introduction To Crypto Research James On YouTube Where To Find New Crypto Projects Being early…

-

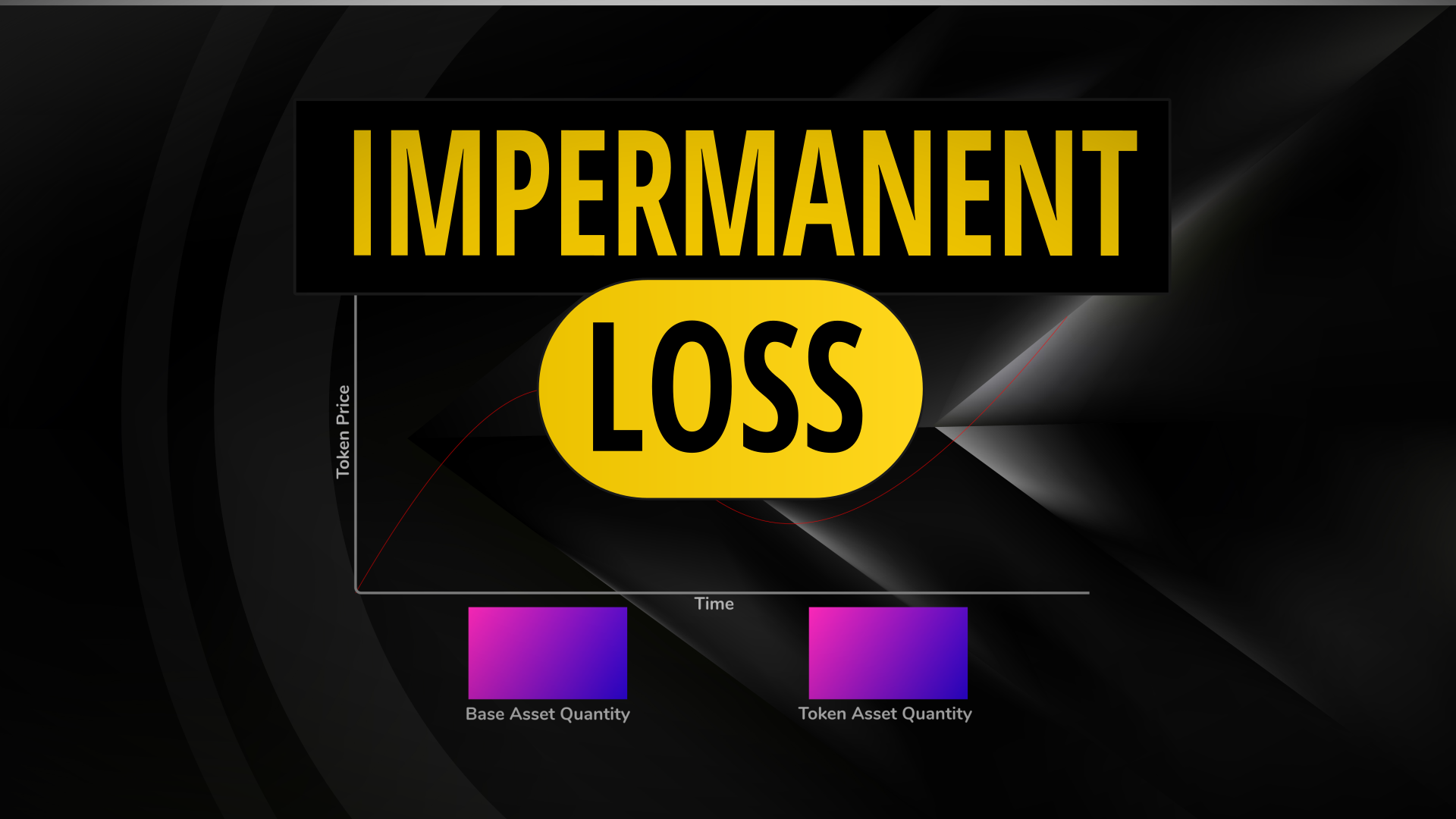

Impermanent Loss Calculator | How To Calculate And Mitigate DeFi’s Biggest Risk

Impermanent Loss Calculator Enter the quantities for the two assets in a full-range liquidity pool and a future price ratio to find out what the impermanent loss would be: Base Asset Qty: Token Asset Qty: Future Price Ratio: Calculate How Impermanent Loss Is Calculated In this article we will look at what impermanent loss is,…

-

Bitcoin ETF | Why A Bitcoin ETF Changes Everything

On Tuesday 3rd August the head of the SEC gave the clearest signal yet that they are readying for the approval of the growing list of Bitcoin ETF products awaiting regulatory approval. “I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded Bitcoin futures” Gary Gensler @…

-

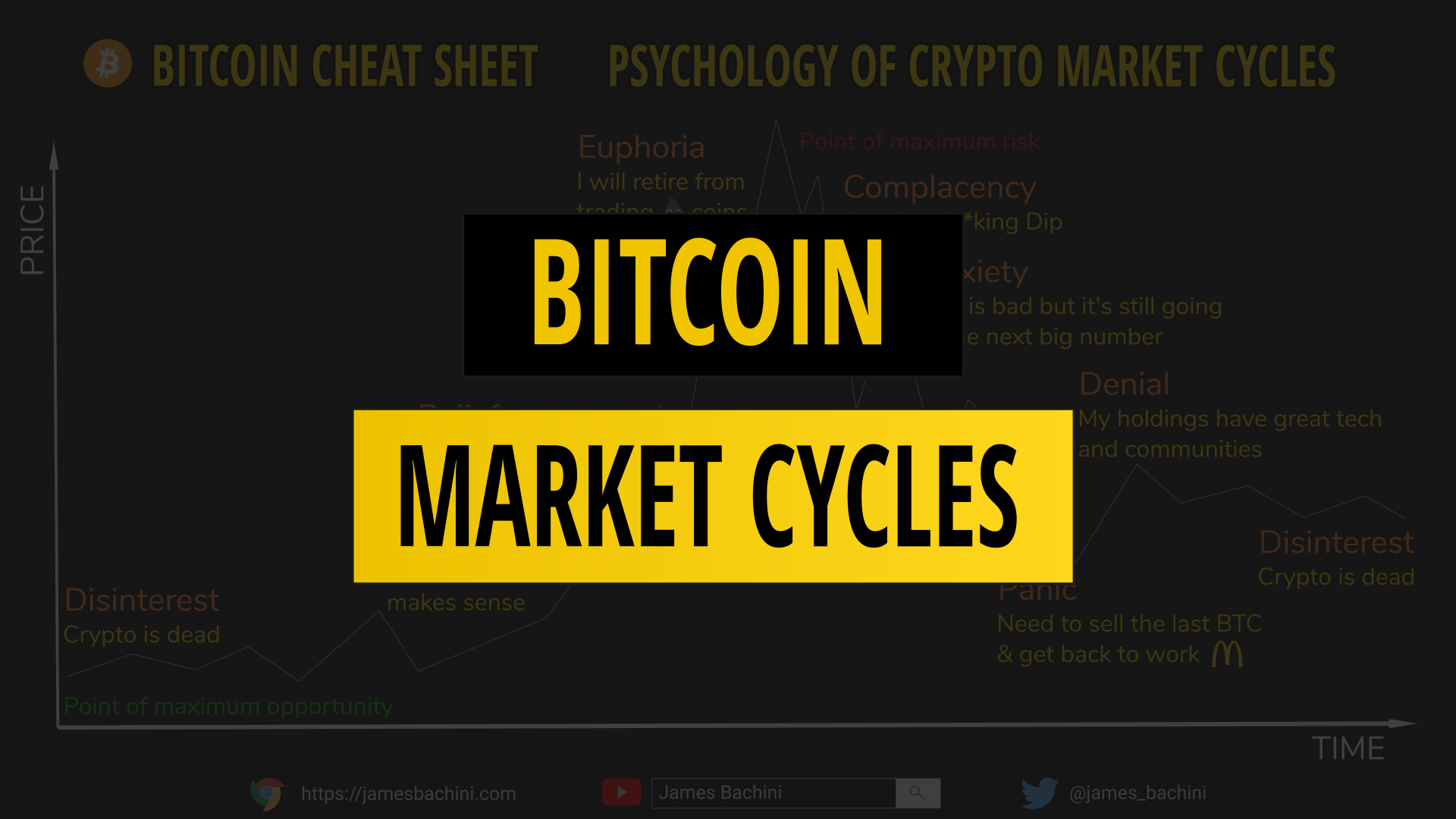

Bitcoin Market Cycle | How To Navigate Crypto Market Cycles 📈

The Bitcoin market cycle is volatile and emotionally challenging for investors but both Bitcoin and the wider crypto sector follow familiar cycle dynamics to other markets. Prophecy Was Given To Fools While I’ve never found a way to predict what the market will do next it’s both useful and fairly easy to understand where you…

-

Bitcoin vs Ethereum | Everything You Need To Know About BTC & ETH

The Bitcoin vs Ethereum debate is passionately argued by maximalists for both sides. This article and video explains the fundamental differences in how they work, what makes them unique and why Ethereum carries more risk and potential reward. Bitcoin vs Ethereum [Video] James On YouTube Fundamental Differences In 2008 an anonymous developer using the pseudonym…

-

Bit.com Review | A New Crypto Exchange

In this Bit.com review I’ll take a first look at a new exchange from the co-founder of Matrixport and Bitmain. Bit.com Review & Demo [Video] James On YouTube Who Are Bit.com? Bit.com is a new exchange registered in the Seychelles offering spot, futures and options markets for digital assets. The chairman is Jihan Wu who…

-

Crypto Portfolio | What I’m Hodling & Why In 2021

In this article I’ll go through my crypto portfolio and explain why I’m holding each of the digital assets. I’ll also be discussing the principles behind the portfolio and how I manage it. The Crypto Portfolio 2021 This is what my crypto portfolio looks like as of July 2021. I’m not a financial advisor, not…

-

Optimism Tutorial | How To Use Optimism On Ethereum

In this Optimism tutorial we will be looking at what Optimism layer 2 is, how to use it and how to develop smart contracts on the Ethereum layer 2. What is Optimism & Layer 2? Optimism is a layer 2 scaling solution for Ethereum which offers lower transaction fees. For consumers who are used to…

-

Arbitrum Tutorial | How To Use The Ethereum Layer 2 Solution

This Arbitrum Tutorial explores what Arbitrum is and how it works, the opportunities layer 2’s present for investors and developers, before testing the deployment of smart contracts on the Arbitrum network and calculating gas fee reductions. What Is Arbitrum? Arbitrum is a layer 2 scaling solution for the Ethereum network. The L2 has opened it’s…

-

How To Create A New Token And Uniswap Liquidity Pool

In this article I will create a new token and make it available to swap on a decentralised exchange. I’ll be deploying a solidity smart contract to mint an ERC20 token on Ethereum and setting up a liquidity pool on Uniswap v3. Create A New Token & Liquidity Pool [Video] This video provides an overview…

-

Certification Of Bitcoin Mining Sustainability ♻️

This article explores Bitcoin mining sustainability and the idea of classifying Bitcoin by how it was mined to incentivise renewable energy. The Video: How To Incentivise Sustainable Bitcoin Mining James On YouTube The Idea: Tracking Bitcoin From Source The idea is to identify the public key addresses of miners who use renewable energy and then…

-

Order Execution Strategy Tests 📋

In this article I’m going to test different methods to find the best order execution strategy for buying and selling cryptocurrency. I’m going to define a test to enter and exit a delta neutral position, write trading bot code for each strategy in NodeJS and execute each on an isolated exchange sub-account to see which…

-

Huobi Exchange Review

Huobi is the second largest crypto exchange in the world by trading volume. In this article I am going to undertake a comprehensive Huobi exchange review looking at trading, fees, HECO and the HT Token. Who is Huobi? Huobi Group was founded in 2013 by Leon Li. Huobi was originally based in Beijing and now…

-

60/40 Crypto Portfolio | The Worlds Most Boringly Effective Cryptocurrency Portfolio

The 60/40 crypto portfolio is a modern version of the stocks and bonds retirement portfolio that has been around for over 70 years. The idea behind a 60/40 portfolio is to allocate 60% of an investment portfolio to high risk assets (stocks or cryptocurrency) and 40% to a yield producing low risk asset (bonds or…

-

Uniswap V3 Trading Bot 🦄

In this tutorial I’ll be explaining how I built Uniswap v3 trading bot in preparation for arbitrage opportunities. We will be looking at why Uniswap v3 is important and how concentrated liquidity pools provide new features such as range orders. I’ll then show how I built and tested the trading bot prior to Uniswap v3…

-

Twitter Trading Bot | Elon + DOGE = Profit

In this article I’ll share how I built a Twitter trading bot to trade a cryptocurrency called DOGE every time Elon Musk tweeted something mentioning it. I’ll be using NodeJS to query the Twitter API and then executing trades on FTX. Building A Twitter Trading Bot Video James On YouTube The “Elon Effect” Opportunity Anything…

-

Sharpe Ratio Explained | How To Calculate Risk Adjusted Returns

In this article we look at how to calculate risk adjusted returns using the sharpe ratio. We look at some modern examples which you can try using the share ratio calculator. Sharpe Ratio Calculator This calculator uses the simplified Sharpe ratio as discussed here. Possibilities Success Chances: % Return: $ Break Even Chances: % Return:…

-

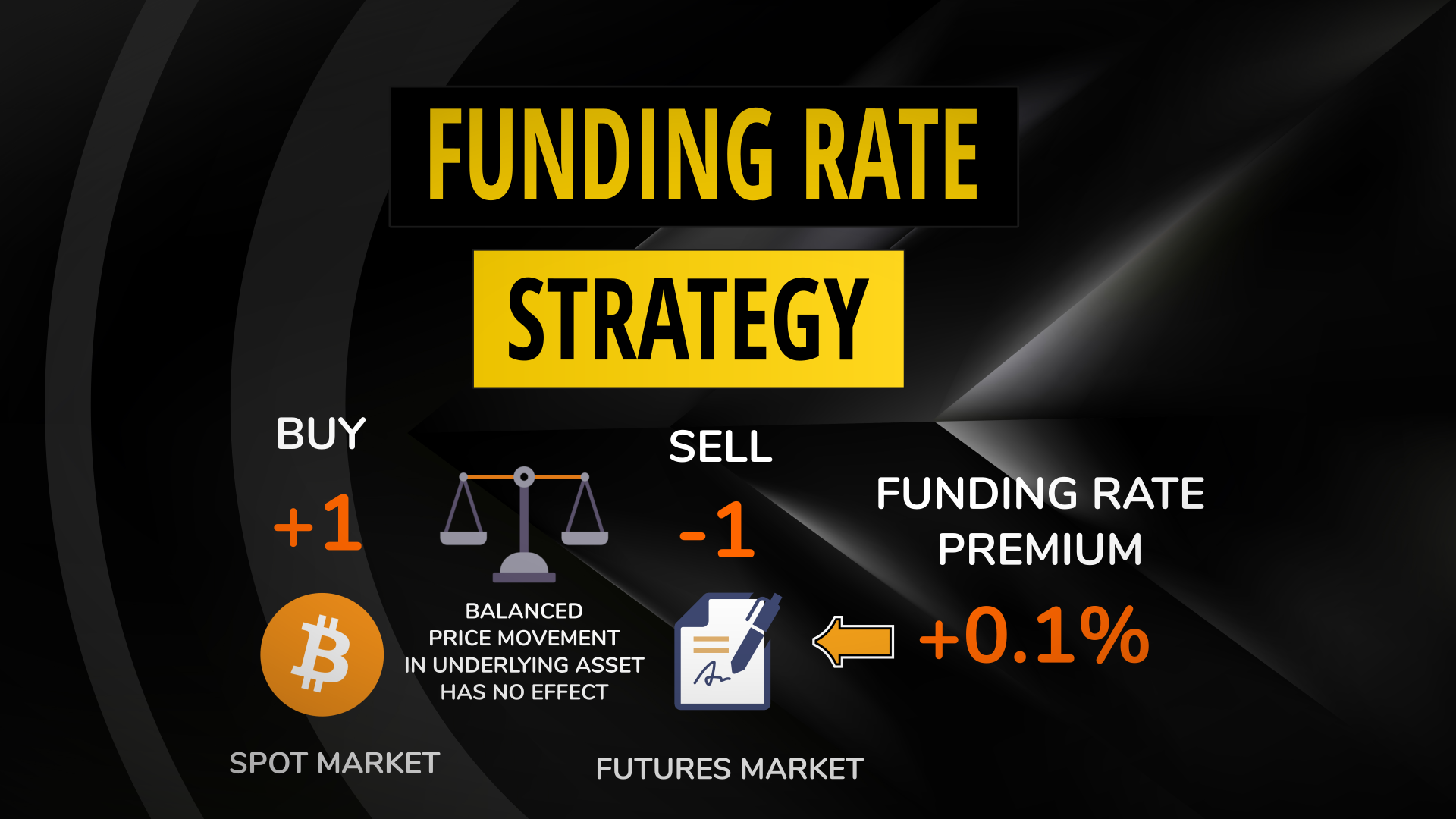

Futures Funding Rate Strategy | Using Binance & FTX To Arbitrage Funding Rates

In this article I’ll be executing a cash and carry trade purchasing a crypto asset on spot markets and short selling a futures contract for the same asset to collect funding rate fees. Understanding Futures Contracts A futures contract tracks the price of an underlying asset. It allows active traders to take out a long…

-

Non Fungible Tokens | My Concerns About NFT’s

In June 2017 John Watkinson and Matt Hall released 10,000 avatars via an automated 24×24 pixel ‘punk’ character generator on the Ethereum network. These non fungible tokens were available to claim for free by anyone with an Ethereum wallet. Four years later and some of these cryptopunk NFT’s are selling for millions of dollars. In…

-

DeFi Passive Income | How To Generate Yield On Crypto Assets

This ultimate how to guide will show you how to earn a passive income on your crypto holdings. We will start by looking at different types of DeFi passive income and how it works. Then I’ll explain how liquidity providers earn transaction fees and explore market leaders including Uniswap, Pancake Swap, Pangolin and Raydium. Finally…

-

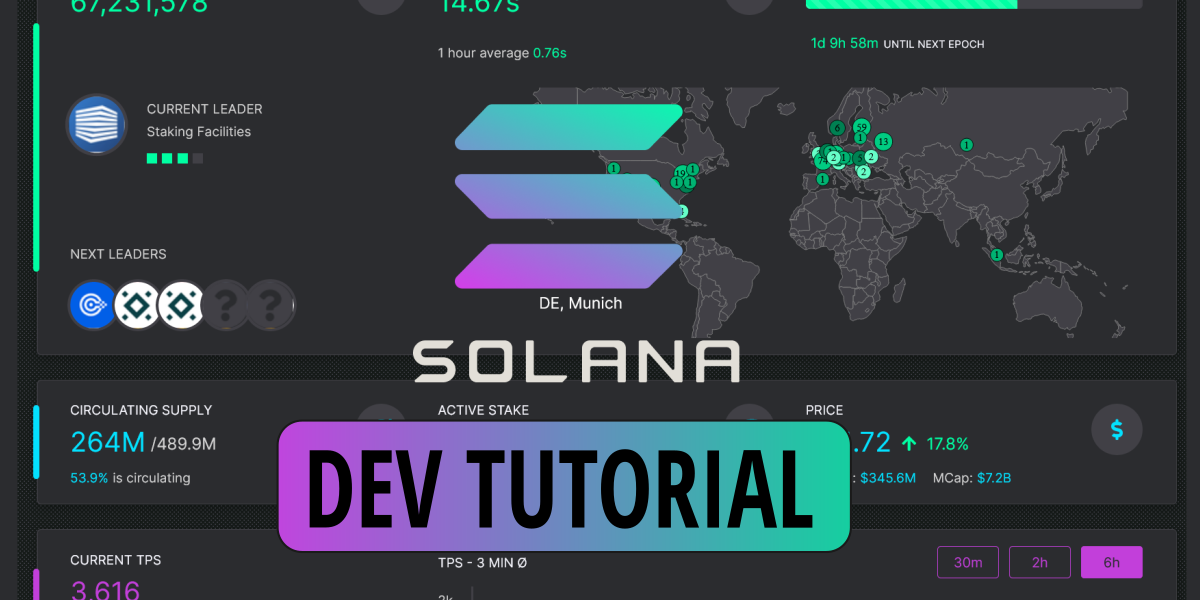

Solana Tutorial | Building Smart Contracts & dApps For The Solana Hackathon

This Solana tutorial goes through a step by step process of setting up a development environment for Solana, writing and deploying smart contracts and my experiences with entering the Solana Hackathon. Getting Started With Solana Solana is a high performance modern blockchain with impressive throughput capabilities. It can handle 50,000 transactions per second which makes…

-

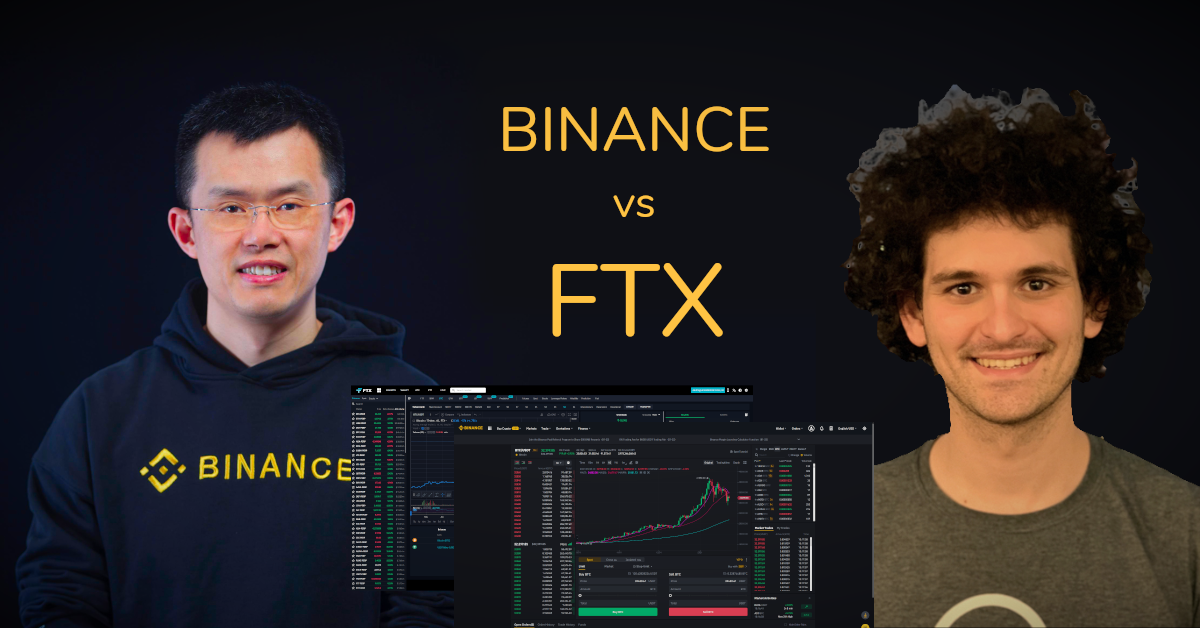

Binance vs FTX | Which Is The Best Crypto Exchange?

Update November 2022. Binance is the best exchange. In this article I’ll explore the differences between Binance vs FTX to find out what each offers and which you should be using. I’ll be assessing a number of factors such as markets, liquidity, security, fees, user interface and API’s. Binance vs FTX [Video] James On YouTube…