DeFi

-

DeFi and the Future of Finance Summary

Book Summary DeFi and the Future of Finance by Campbell R. Harvey, Ashwin Ramachandran, and Joey Santoro DeFi and the Future of Finance presents a compelling case that decentralized finance is not a niche experiment but a transformative technological and economic force that could reshape the structure of global financial systems. The core thesis is…

-

Tokenomics 101 Designing Effective Token Models

Tokenomics Fundamentals Tokenomics refers to the economic model and framework that governs the use, distribution, and value of tokens. At its core, tokenomics is the study of the supply and demand of tokens, how they incentivise users and developers, and the role they play in driving network effects. Unlike traditional currencies, tokens are highly versatile…

-

Prediction Markets Solidity

Prediction markets are decentralized platforms where participants can bet on the outcome of future events. For example, people could bet on the outcome of a presidential election or a sports game. In this tutorial, we will walk through a smart contract built on Ethereum, which allows users to create and participate in prediction markets. The…

-

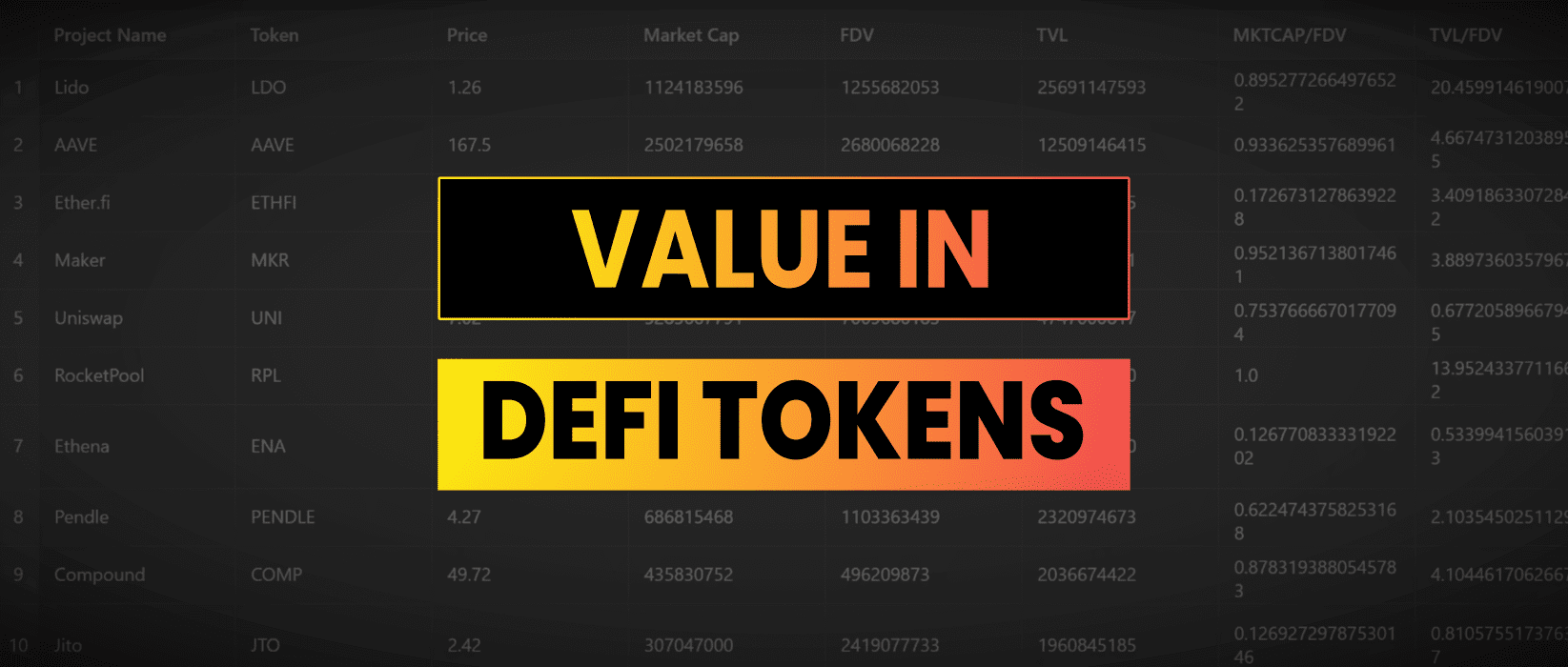

Value Investing In DeFi

For value investors the goal is to find assets priced below their intrinsic value, providing a margin of safety and potential for significant future growth. Could applying this principle to DeFi help identify underappreciated projects that are gaining significant traction. Let’s find out… Market Cap, TVL & FDV Market capitalization is the total value of…

-

7 Problems That DeFi Solves

Last month Vitalik caused a stir when he suggested that DeFi “can’t be the thing that brings crypto to another 10-100x adoption burst” In this article I’m going to share my thoughts on why DeFi is still the no.1 most important use case for Ethereum. Lack of Financial Inclusion In a world where millions remain…

-

Pump.fun Clone In Solidity

Pump.fun is a token factory that lets users create and trade memecoins on Solana with dynamic pricing along a bonding curve. In this article I’ll show how I went about converting this concept to Solidity and deploying it on Ethereum. Full code for this is open source at: https://github.com/jamesbachini/Pump.sol Token Factory Contract At the core…

-

Over-Collateralized Lending In DeFi

Decentralized finance has opened up many possibilities for holders of digital assets. One of the products which has gained traction over the last few years has been over-collateralized lending which is now a $30+ billion dollar industry. In this article I’m going to look at how over-collateralized lending works, why would someone want to do…

-

The Future Of Bitcoin, Ethereum & Web3

In this article I’m going to discuss where I think the industry is going over the next decade and how emerging developments will affect the following: Bitcoin Bitcoin, the pioneer and household name of crypto, has not evolved significantly from its origins as a digital currency. It is becoming increasingly recognized as a mainstream financial…

-

DeFi Whale Watching Tutorial & Code

Imagine if you could tap into the strategies of top investors and see where the smart money is allocating capital? Welcome to the world of DeFi whale watching, where tracking high net worth wallets can give you the edge and open up new Whale Watching Explained DeFi whale watching involves tracking the investments of “smart…

-

DeFi Analysis With Rust

In this tutorial I’m going to provide some code and show you how to monitor the number of depositors to Eigenlayer over the last 24 hours. We will be using Rust with the Tokio and Ethers libraries along with the Infura API which you can get a free key from here. The first thing we…

-

Structured Products DeFi

We all remember the 2008 financial crisis, a global upheaval sparked in part by complex structured products like collateralised debt obligations. These financial instruments are still widely used in traditional finance to manage risk and enhance returns. But what if we could reimagine these products in DeFi? In this article, we’ll explore how decentralised structured…

-

Frontrunning Crypto Catalysts For Fun & Profit

There is opportunity in crypto markets if you can get ahead of the next narrative and allocate capital prior to mass of market participants. Staying ahead of the curve often means keeping an eye on emerging trends and strategic moves that can significantly impact a project’s market perception and value. In this article I’m going…

-

Ethena USDe | DeFi Analysis Report

Ethena Labs has introduced USDe, a synthetic dollar on the Ethereum blockchain. USDe is designed to be crypto native, stable and censorship resistant. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Ethena or USDe at time of writing. Do your…

-

Starknet STRK Tokenomics

Starknet is a layer 2 zero knowledge rollup which uses a STARK cryptographic proof and Cairo based smart contracts. A few days ago they released the STRK token and in this article I’ll dive in to the tokenomics. Currently at time of writing the token trades at $1.91 and has a $1.39 billion dollar circulating…

-

Sell Me This Pen.sol

What happens when you ask a blockchain developer to sell you a pen? Etch your words permanently on the Ethereum blockchain where they will outlive you & create an everlasting record of your thoughts, contemplations & predictions. This is your chance to leave an eternal mark and express your presence in the digital age while…

-

ATOM Cosmos Analysis | A Deep Dive Into The Cosmos Ecosystem

This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ATOM at time of writing. Do your own research, not investment advice. What Is Cosmos Cosmos is a decentralized layer zero network of independent blockchains, designed to enable scalability and interoperability between…

-

GEAR Gearbox Protocol | DeFi Analysis Report

Gearbox Protocol introduces a framework for both passive lenders and active borrowers. It empowers traders with leverage that can be used to scale up trades and yield farming strategies on decentralized exchanges such as Unsiswap and Curve. With an emphasis on composable leverage, zero funding rates, and permissionless strategies, Gearbox Protocol is an compelling microcap…

-

Asymmetry Finance | DeFi Analysis Report

Asymmetry Finance has emerged as a significant player in the liquid staking wars, offering an aggregated liquid staking token. This article explores the core functionalities of Asymmetry Finance and its core product safETH. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure…

-

Emergent use cases for self-sovereign identity in DeFi

Abstract The DeFi sector is facing increased regulatory pressure to de-anonymize certain transactions and user profiles, while simultaneously dealing with flagging user confidence in terms of their individual rights to data privacy. This is providing fertile ground for innovative companies to try to allow end users to be the sovereign of their own identity and…

-

eBTC How To Trade The Flippening

eBTC is an over-collateralized digital asset pegged to the price of Bitcoin which can be minted using stETH as collateral. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to eBTC at time of writing. Do your own research, not investment advice.…

-

MUX Protocol | DeFi Analysis Report

MUX is a decentralized trading platform offering slippage free trades and 100x leverage. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to MUX at time of writing. Do your own research, not investment advice. The first thing that jumps out about…

-

Investing In Real World Assets Through DeFi

Real world assets (RWA) are tokenized digital forms of traditional finance assets. A centralized entity will raise capital by selling tokens and investing the proceeds in to an underlying asset or strategy. This has become particularly popular with bonds and treasuries due to recent rises in interest rates. The market leaders in this field by…

-

Brine Finance | DeFi Analysis Report

Brine Finance is a decentralized orderbook exchange built on Starkware. They recently raised $16.5m at a valuation of $100m in a round led by Pantera Capital. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to Brine at time of writing. Do…

-

Radix DLT | DeFI Analysis Report

Radix is a layer one blockchain which has recently gone live on mainnet enabling developers to deploy scrypto smart contracts. In this report I’ll explore the novelties of the technology, dive into the scrypto programming language, look at the excellent developer resources, analyze the tokenomics of the native XRD token and draw a conclusion on…

-

HyperLiquid | Decentralized Perpetual Futures Trading

Hyperliquid is a decentralized exchange that specializes in perpetual futures contracts. It’s seen modest growth through a difficult bear market and has a frontend remarkably similar to FTX. Let’s dive in. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to HyperLiquid…

-

VEGA DeFi Derivatives Protocol | DeFi Analysis Report 🔍

VEGA is a dedicated appChain built for decentralized derivatives such as futures and options contracts. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to VEGA at time of writing. Do your own research, not investment advice. Vega is a infrastructure layer…

-

ApeX Pro | DeFi Analysis Report

ApeX Pro is a non-custodial decentralized orderbook exchange which is part of the ByBit group. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any exposure to ApeX at time of writing. Do your own research, not investment advice. What Is ApeX Pro?…

-

Solidity Tutorial | Gas Paying NFT

The challenge is to create a NFT contract that charges 1 ETH to mint but then stores the entire amount as collateral in a liquid staking token. As staking rewards come in they get distributed to the holders of the NFTs. At any time a user can burn the NFT to reclaim the 1 ETH.…

-

Chainlink CCIP | Cross-Chain Interoperability Protocol

From all the announcements at ETHcc, the release of Chainlink CCIP as a direct competitor to LayerZero for cross-chain communications and bridging technology, is perhaps the most interesting. The inherent security risks associated with bridging technology means that Chainlink are in a good position to leverage their brand and security record to gain traction in…

-

Using Ethereum To Offset Bitcoin’s Carbon Footprint

Never have I sounded more like an Ethereum maxi, but there is a point beyond the provocative title. In this post I’m going to explore the potential for investors to use carbon credit tokens on Ethereum to offset the electrical consumption of BTC mining on their Bitcoin holdings. This novel idea provides the opportunity to…

-

Spark Protocol sDAI | DeFi Analysis Report

Does earning 8% on your DAI stablecoin holdings sound too good to be true? Let’s take a look at how Spark Protocol is offering this APR using MarkerDAO’s Enhanced Dai Savings Rate system. This is a write up of my internal research notes, this is not a sponsored post and I do not hold any…

-

Tokenized US Treasuries | Ondo Finance vs MatrixDock

Tokenized US treasuries offer a yield on stablecoin holdings and with rising interest rates they are quickly gaining traction in DeFi markets. In this article I want to look at two projects to see how they compare and how the real world asset ecosystem is shaping up. Real World Assets In the last six months…

-

Automate Solidity With MEV

There are no cron jobs in Solidity or native to the Ethereum blockchain. To automate Solidity code we can either use an external service/oracle or we can incentivise MEV searchers to complete tasks efficiently on our behalf. This type of Solidity automation is very common and used widely across liquidation systems which require reliable, fast,…

-

ETHx Stader Labs | DeFi Analysis Report

ETHx from Stader Labs is a solution committed to decentralization and keeping Ethereum accessible, reliable, and rewarding. Having just launched ETH stakers earn 1.5x staking rewards and $800,000 in DeFi incentives across various protocols for the first month. This is a write up of my internal research notes, this is not a sponsored post and…

-

Conic Finance | DeFi Analysis Report

The latest development in the Curve Wars is the establishment of a new player. Conic Finance is gaining traction and becoming a significant player in the stable swap ecosystem. This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of…

-

crvUSD Curve Stable | DeFi Analysis Report

Curve finance recently launched their own stablecoin crvUSD. I was lucky enough to meet one of the developers working on crvUSD at ethDenver and have been impressed with the product and how it has been rolled out. It is an algorithmic stablecoin with massive potential backed by one of the biggest names in DeFi, let’s…

-

Raft Finance | DeFi Analysis Report

This DeFi analysis report for Raft Finance follows up on my analysis and investment in Lybra Finance. This is a write up of my internal research notes, this is not a sponsored post and I do not have any allocations at time of writing to Raft or the R stablecoin. Do your own research, not…

-

Lybra Finance | DeFi Analysis Report

Lybra Finance allows stETH stakers to mint the eUSD stablecoin which has a 7.2% APY. This is a write up of my internal research notes, this is not a sponsored post however I have purchased an allocation of LBR Lybra Finance’s governance token in my personal portfolio. Do your own research, not investment advice. Update…

-

Prisma Finance | acUSD an LST backed stablecoin

Prisma Finance is a DeFi project that aims to maximize the potential of Ethereum liquid staking tokens (LSTs). It introduces a stablecoin called acUSD, which is over collateralized by liquid staking tokens. The stablecoin is designed to be capital-efficient and offers additional incentives through integration with Curve and Convex Finance. This is a write up…

-

Alchemix Self-Repaying Loans

Imagine a financial system where your loans automatically pay themselves off, interest-free and without the need for monthly repayments. Alchemix is a synthetic asset protocol run by community DAO. This is a write up of my research notes and is not sponsored in any way. I currently at time of writing have no stake in…

-

Snapshot | Gasless Voting for Decentralized Communities

In decentralized communities voting plays a crucial role in governance and development of roadmaps. Snapshot is disrupting the traditional DAO voting model with a gas free voting platform. This is not a sponsored post and I have no stake in Snapshot, I do however like to use and promote open source tools which enable decentralized…

-

Introduction to Flash Loans | Unleashing Capital On Demand

In this tutorial on flash loans we will be creating a Solidity smart contract which takes a flash loan from Uniswap v3. This allows you to borrow huge amounts of capital with the catch that you have to pay it back in the same block or the whole transaction is reverted. James On YouTube Watch…

-

Uniswap Market Maker Bot | Managing Token Liquidity On Uniswap

In this tutorial I am going to go through how I built a market maker bot to manage liquidity on Uniswap v3 for a token pair. The idea is to create a automated trading bot which buys tokens when price falls below a base line value and sells tokens when price is above the base…

-

MEV Uncovered | The Dark Side Of DeFi

MEV (Maximal Extractable Value) is a term used to describe the maximum value that can be extracted from block production beyond the standard block reward and gas fees by including, excluding, and changing the order of transactions in a block. MEV can be thought of as the economic value that arises from the ability to…

-

RDNT v2 Radiant Capital | DeFi Analysis Report

Earlier this year Radiant Capital launched Radiant v2, an omnichain lending protocol. This is a write up of my internal research notes, this is not a sponsored post and I have no allocation at time of writing in Radiant or RDNT. Radiant is a DeFi platform that allows users to lend and borrow digital assets…

-

Web3 Investment Thesis

This Web3 investment thesis covers the potential disruption from decentralized permissionless computing. As blockchains scale it’s going to be possible to use smart contracts to enable users to store their own data creating the opportunity for a new era of decentralized applications. Web3 Disrupting Data Web3 disrupts the way we store data online by using…

-

DeFi Futures – GMX vs DyDx

Trading DeFi Futures products on decentralized exchanges such as GMX and DyDx has never been easier. The user experience is getting close to on par with centralized exchanges. Liquidity however, not so much… In this article we will look at how DeFi futures work, the market opportunity for decentralized futures exchanges and the two most…

-

EigenLayer | DeFi Analysis Report

EigenLayer is a protocol which allows Ethereum stakers to restake their ETH. This is a write up of my internal research notes, this is not a sponsored post and I have no stake currently in EigenLayer. EigenLayer is being developed by EigenLabs which is headed by CEO Sreeram Kannan. Sreeram has an academic background and…

-

GammaSwap Pepetual Futures | DeFi Analysis Report

GammaSwap is a decentralized exchange that allows perpetual leverage trading on any token without liquidation risk from price movement, while also offering additional yield to liquidity providers through borrow fees. In this article I will write up my internal research notes, this is not a sponsored post and I currently have no stake in GammaSwap.…

-

Timeswap v2 AMM Money Market | DeFi Analysis Report

Ricsson Ngo took inspiration from Uniswap and set out to build a permissionless money market. The idea evolved into Timeswap which recently launched on Arbitrum. In this article I’ll write up my own notes and internal research on the protocol. Note this is not a sponsored post and I don’t currently hold any stake in…

-

ERC20 Carbon Credits | Creating A Depleting Token

Carbon credits are used to tokenise finances put towards carbon offsetting. On-chain products often have a purchase and burn mechanism where a user must first purchase the token on a DEX and then manually execute a transaction to burn the token. I had the idea to create a automatically depleting token which you just hold…

-

How To Stake Ethereum | Earn More Yield With Ethereum Staking

Staking Ethereum has become a popular way for crypto investors to earn passive returns on their holdings. Liquid staking tokens like stETH make this process easily accessible. You can buy staking tokens and effortlessly enjoy the rewards of staking Ethereum without having to manage the technicalities of running a node. Lido Finance were first to…

-

Mean Finance | How To DCA With DeFi

Mean Finance is a DeFi protocol that enables users to dollar cost average (DCA) into a position for an ERC-20 token. In this article we will look at why dollar cost averaging is useful and how Mean Finance works. Why Dollar Cost Average Dollar cost averaging is an investment strategy that simply breaks a entry…

-

RAILGUN 2.0 | ZK Privacy Protocol

Railgun just announced the launch of version 2.0 this week and in this article we are going to explore the zero knowledge wallet and discuss why privacy protocols are important. In August 2022 Alexey Pertsev was arrested and he has been imprisoned without trial ever since. He was a developer on a ZK mixer called…

-

Yield Futures With Resonate Finance

Resonate Finance is building a protocol for the creation and sale of yield futures. In this article we will look at what yield futures are, how they can benefit a projects tokenomics & why investors might find them attractive. This post isn’t sponsored and I currently have no stake in Resonate Finance or Revest at…

-

Solidity Tutorial | Fixed Rate Staking Contract

In this tutorial we will create a fixed rate staking contract that pays out 1 token for every 1 token staked per year. The contract will be built on an OpenZeppelin ERC20 token library with additional functionality for staking. The user will stake their tokens which will lock them in the smart contract at what…

-

Zero Knowledge Proof | How ZKP Works In Blockchain Applications

Zero knowledge proofs offer a method for developers to prove data validity or knowledge of data without revealing the data or additional information about the prover. Zero knowledge proofs are becoming widely used in blockchain applications from smart contracts like Tornado Cash to ZKrollups which are layer 2 blockchains on top of Ethereum. In this…

-

Solidity Interface Examples | How To Connect The Lego Bricks Of DeFi

Solidity interfaces allow developers to call external contracts from within their own smart contract. This enables us to build on top of the existing DeFi ecosystem. In this tutorial we will be looking at how solidity interfaces work and going through some example code for common tasks. James On YouTube Watch On YouTube: https://youtu.be/GWZmklp7RTg |Subscribe…

-

5 DeFi Growth Metrics For Better Valuations

Growth metrics have been used by tech VC’s for years to predict and monitor companies growth patterns. Terms like CAC (Customer acquisition cost) and LTV (Lifetime value) are critical to how we value startups in the traditional space. In DeFi the landscape is different and the metrics that we use are too. However on-chain transparency…

-

The Rise Of DyDx And Decentralized Trading

In May 2016 Bitmex launched the XBTUSD market, a perpetual futures contract which simplified traders ability to bet on the price of Bitcoin going up or down. Today perps are traded on the major exchanges at higher volumes than the underlying spot assets. DyDx took this concept and packaged it in to a decentralized trading…

-

How To Trade Crypto | Ultimate Guide To Trading Bitcoin, Ethereum & Altcoins

This ultimate “How To Trade Crypto” guide is provided for educational purposes. I am not a financial advisor, not financial advice. The vast majority of active trading in crypto markets is done on centralized exchanges such as Binance and FTX. The high volumes on perpetual futures on both exchanges has proven the demand for leveraged…

-

How To Automate Yield Farming | Harvesting Rewards With A Quick & Dirty Script

Connect wallet, click button, confirm transaction. It gets old pretty quick, especially when you need to do it daily to compound returns. This tutorial takes you through the process of using a block explorer to find functions, calling those functions from a script and then executing to harvest and stake reward tokens. The aim is…

-

When Will Ethereum 2.0 Launch & The Triple Halving Event

Ethereum 2.0 is the biggest update that the crypto sector has ever seen. A series of rollouts will include a migration to proof of stake, sharding and the highly anticipated triple halving event. This article will discuss the roadmap for these rollouts, what changes each update will implement and the possible effects. Ethereum 2.0 Roadmap…

-

Crypto Oracles | Moving Data On-Chain

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance Crypto oracles provide an essential bridge between off-chain and on-chain data. If a smart contract needs access to price feeds, random numbers or external data they will need to use an oracle because the…

-

DeFi Borrowing & Lending

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance DeFi borrowing and lending differs from traditional finance where institutions will lend funds based on credit ratings. In DeFi accounts are anonymous, there are no credit ratings to assess risk. Borrowing and lending is…

-

Synthetic Assets | A Regulatory Nightmare

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance Synthetic assets are a form of derivative product in decentralised finance. Synths are created which follow the price of an underlying asset. For example sTSLA will follow the stock price of Tesla and can…

-

The Token Economy

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance The token economy is the accelerating migration of assets into the digital world. One of the first breakthroughs for Ethereum was a smart contract that facilitated the creation and transfer of tokens. Anyone who…

-

The Truth About dApps & Web3

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance If smart contracts form the back end brains of a DeFi platform then dApps or decentralized applications form the front-end that we interact with as users. In theory dApps can be compiled from source…

-

Smart Contracts Simply Explained

This article is derived from a chapter in the free eBook explaining DeFi technologies:DeFi Demystified | An Introduction To Decentralized Finance Decentralized finance is built on smart contracts. The code that enables users to lend, borrow and swap tokens is all run on Ethereum’s virtual machine. Smart contracts are written (mainly) in the language of…

-

Understanding Squeeth | A Token To Track ETH² From Opyn

Squared ETH or Squeeth is a perpetual options protocol that provides unlimited upside leverage with no liquidations on long positions. Squeeth isn’t just a tool for traders, it can be used as a hedge for liquidity providers on Uniswap and it can provide a funding rate yield in sideways markets. This article starts at the…

-

The Truth About Where Yield Comes From In DeFi

Interest rates in traditional banks are 0.1%, have you ever wondered how DeFi yield farmers are getting 20-100% yields on their digital assets? Is it sustainable wealth creation or a giant ponzi that risks collapsing in on itself. That’s the question we are going to explore in this article looking at where yield comes from…

-

How To Make Cross Chain Transfers With Multichain

I’ve seen Anyswap popping up more and more in on-chain analytics reports as it’s grown to be a six billion dollar protocol by TVL. The platform just rebranded to Multichain and its fast becoming the market leader in cross chain bridges. If you want to transfer USDC from Ethereum to Polygon or Fantom or another…

-

DeFi Risk | A Framework For Assessing & Managing Risk in DeFi

The high yields available in decentralised finance come with a downside. DeFi risk is real and if you are participating in the markets then you should know how to assess and manage that risk. By building a risk assessment framework for yield farms and DeFi opportunities we can better assess fair value and allocate capital…

-

Crypto Index Funds | Set Protocol & Index Coop

This article looks at the future of crypto index funds running on DeFi and in particular the Set Protocol and Index Coop. Crypto index funds known as sets provide a single token which represents a managed or fixed fund of digital assets. Index Funds in TradFi and DeFi In traditional finance index funds are the…

-

112 DeFi Definitions | Blockchain Glossary

The blockchain community has its own language and abbreviations which can seem quite daunting at first glance. Here is a glossary of defi definitions and terms that you’ll want to know and understand to interact in the space. AML (Anti-Money Laundering) Regulations applicable in most international markets aimed at preventing criminal activity. Anti-Money Laundering regulations…

-

Impermanent Loss Calculator | How To Calculate And Mitigate DeFi’s Biggest Risk

Impermanent Loss Calculator Enter the quantities for the two assets in a full-range liquidity pool and a future price ratio to find out what the impermanent loss would be: Base Asset Qty: Token Asset Qty: Future Price Ratio: Calculate How Impermanent Loss Is Calculated In this article we will look at what impermanent loss is,…

-

Bitcoin vs Ethereum | Everything You Need To Know About BTC & ETH

The Bitcoin vs Ethereum debate is passionately argued by maximalists for both sides. This article and video explains the fundamental differences in how they work, what makes them unique and why Ethereum carries more risk and potential reward. Bitcoin vs Ethereum [Video] James On YouTube Fundamental Differences In 2008 an anonymous developer using the pseudonym…

-

Crypto Portfolio | What I’m Hodling & Why In 2021

In this article I’ll go through my crypto portfolio and explain why I’m holding each of the digital assets. I’ll also be discussing the principles behind the portfolio and how I manage it. The Crypto Portfolio 2021 This is what my crypto portfolio looks like as of July 2021. I’m not a financial advisor, not…

-

How To Create A New Token And Uniswap Liquidity Pool

In this article I will create a new token and make it available to swap on a decentralised exchange. I’ll be deploying a solidity smart contract to mint an ERC20 token on Ethereum and setting up a liquidity pool on Uniswap v3. Create A New Token & Liquidity Pool [Video] This video provides an overview…

-

Uniswap V3 Trading Bot 🦄

In this tutorial I’ll be explaining how I built Uniswap v3 trading bot in preparation for arbitrage opportunities. We will be looking at why Uniswap v3 is important and how concentrated liquidity pools provide new features such as range orders. I’ll then show how I built and tested the trading bot prior to Uniswap v3…

-

DeFi Passive Income | How To Generate Yield On Crypto Assets

This ultimate how to guide will show you how to earn a passive income on your crypto holdings. We will start by looking at different types of DeFi passive income and how it works. Then I’ll explain how liquidity providers earn transaction fees and explore market leaders including Uniswap, Pancake Swap, Pangolin and Raydium. Finally…

-

Decentralised Finance | A Comprehensive Guide To DeFi

Decentralised finance is revolutionising the blockchain sector. It provides a playground of opportunities for investors, traders and developers. This article provides a comprehensive in depth guide to everything DeFi. What Is Decentralised Finance? Decentralised finance is an extension of cryptocurrency and blockchain applications enabling borrowing, lending, trading and investing. DeFi provides financial services through the…